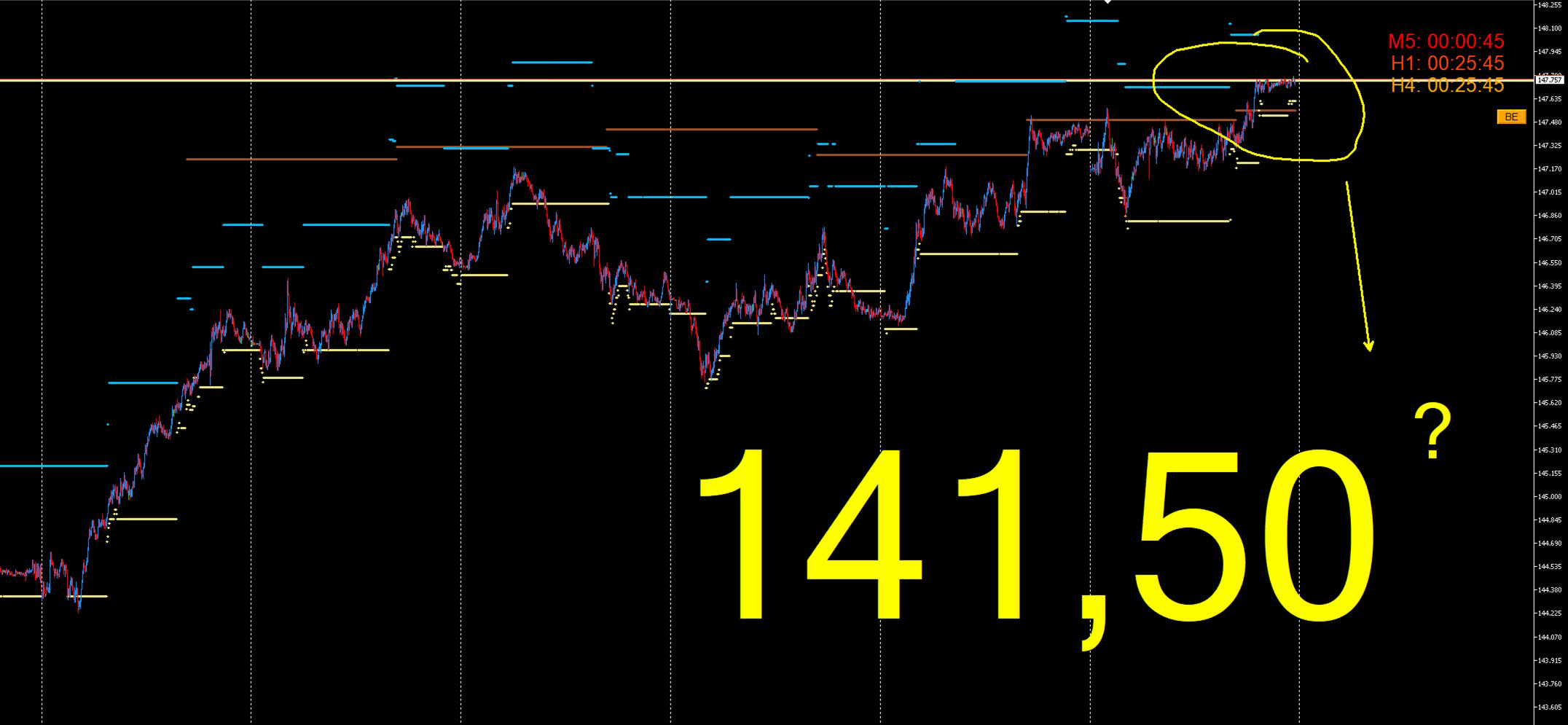

Khaki Level and the Sienna3 Perspective

The U.S. Dollar to Japanese Yen (USD/JPY) currency pair has arrived at an exceptionally interesting juncture. The price has reached the crucial, long-awaited Khaki price level, identified within the DML (Deep Market Levels) methodology. Reaching this "pending" zone suggests that the market has entered an area where significant institutional orders or unrealized market objectives may have been concentrated in the past.

This situation presents market participants with a fundamental question: will the Khaki level act as definitive resistance, initiating a downward wave, or will it be absorbed by buying pressure? In the context of DML analysis, the attention of observers is now turning to another significant pending level – Sienna3, located in the 141.50 price area. A potential move in this direction would signify a substantial appreciation of the Japanese yen and a deep correction for this currency pair.

Macroeconomic Context – A Clash of Monetary Policies

Movements in the USD/JPY pair are inextricably linked to the divergence (or lack thereof) in the monetary policies of the U.S. Federal Reserve (Fed) and the Bank of Japan (BoJ). To assess the probability of the bearish scenario, we must analyze the current fundamentals.

- U.S. Dollar (USD): The Federal Reserve is currently in a phase of evaluating the effects of its previous policy tightening cycles. The market is closely scrutinizing all data on inflation, the labor market (employment, wages), and GDP growth. Any signs of an economic slowdown or a sustained drop in inflation in the U.S. could prompt the Fed to soften its rhetoric and, in the longer term, even consider interest rate cuts. Such a scenario would fundamentally weaken the dollar.

- Japanese Yen (JPY): The Bank of Japan has long been under pressure to normalize its ultra-loose monetary policy. Key for the BoJ are data on inflation and wage growth dynamics in Japan. If wage and inflationary pressures remain elevated, the likelihood of abandoning Yield Curve Control (YCC) or even raising interest rates from negative levels would increase. Such a prospect would be a powerful catalyst for yen appreciation.

Conclusion: A bearish scenario for USD/JPY towards 141.50 would be strongly supported by the simultaneous occurrence of two factors: a dovish stance from the Fed (signals of rate cuts) and hawkish signals from the BoJ (signals of policy normalization).

Analysis of DML Levels in Market Dynamics

The DML methodology assumes that markets often move between predetermined zones of high significance, which do not necessarily align with classic technical analysis levels.

- The Significance of the 'Khaki' Level: The arrival at the "pending" Khaki level can be interpreted as the closing of a certain market cycle. It is a zone where the demand side, which has dominated so far, meets a historically significant supply barrier. At this point, profit-taking orders from long positions may be activated, and new sell orders may emerge from large players who were waiting for this specific price zone. The price reaction in the coming days (or even hours) will be crucial – a strong rejection and the formation of a local peak would confirm the importance of this level.

- The Logic of the 'Sienna3' Target (141.50): The Sienna3 level, also classified as "pending," represents another area the market may gravitate towards after exhausting its upward potential. In market logic, after equilibrium is broken at one key point (Khaki), the price often moves towards the next zone of high historical order density or interest. The 141.50 level would therefore serve as a target for a new, medium-term downtrend, should one be initiated.

Potential Scenarios

Primary Scenario – Bearish Reaction and Move Towards 141.50:

- Description: The price fails to sustainably break above the Khaki level. After a brief consolidation or a false breakout, a strong downward move is initiated.

- Confirmation: A break of recent local lows, the price remaining below the Khaki level, and support from macroeconomic data (e.g., weaker U.S. data, stronger signals from Japan).

Alternative Scenario – Consolidation and Base Building:

- Description: The Khaki level proves to be a zone of equilibrium rather than a turning point. The market enters a sideways range around this level, with trading characterized by lower volatility.

- Implications: Large institutions may use this time to accumulate or distribute their positions. Prolonged consolidation without a clear rejection of the level could weaken its significance as resistance.

Negation Scenario – Level Invalidation and Continued Uptrend:

- Description: Demand is strong enough to decisively overcome the Khaki level, which is then confirmed as new support.

- Confirmation: Several consecutive session closes above the Khaki level, supported by strong pro-dollar data or a dovish surprise from the Bank of Japan. In this case, the 141.50 target would be invalidated in the current cycle.

Summary

The USD/JPY pair is at a decisive moment. Reaching the pending DML Khaki level represents a technical confrontation, the outcome of which could define the trend for the coming weeks or even months. Although a bearish scenario towards the pending Sienna3 level (141.50) is logical in the context of closing market cycles, its realization will depend strictly on incoming macroeconomic data and central bank communications. The key will be to observe whether market fundamentals provide the necessary fuel for such a significant shift in sentiment.

This analysis is for informational and educational purposes only. It does not constitute investment advice or a trade recommendation within the meaning of applicable regulations. The author is not responsible for any investment decisions made based on the above content.