GBPCAD

The GBPCAD currency pair combines the British pound sterling (GBP), the currency of the United Kingdom, with the Canadian dollar (CAD), the currency of Canada. The British pound is one of the oldest and most influential currencies globally, reflecting the economic health of the UK. The Canadian dollar is considered a commodity currency due to Canada's strong economic ties to the export of commodities, particularly crude oil and metals.

Characteristics and Specifics

- Monetary policy and interest rates: Interest rate differentials between the UK and Canada affect capital flows and the attractiveness of investments in both currencies. Traders closely monitor BoE and BoC decisions, as they can lead to significant movements in the GBPCAD pair.

- Commodity influence: The Canadian economy is heavily dependent on commodity exports, especially crude oil. An increase in oil prices typically strengthens the CAD, potentially causing the GBPCAD exchange rate to fall. Conversely, a decrease in commodity prices can weaken the CAD and strengthen the GBP in this pair.

- Political and economic factors: Political events such as trade negotiations, fiscal policies, and government changes in both the UK and Canada can affect this currency pair. Events related to Brexit have introduced significant volatility to GBP in recent years.

- Macroeconomic data: Releases of indicators such as GDP, inflation, unemployment rates, and trade balances from both countries directly influence the values of GBP and CAD. Strong economic data from the UK can boost GBP, while positive data from Canada can strengthen CAD.

Summary

The GBPCAD currency pair offers traders numerous trading opportunities due to the influence of diverse economic and political factors. Differences in monetary policy between the Bank of England and the Bank of Canada, fluctuations in commodity prices, and political events can lead to significant movements in this pair.

- Macroeconomic data: Regularly following releases from both countries will help anticipate potential exchange rate movements.

- Commodity prices: Particularly oil prices, which have a direct impact on the CAD.

- Monetary policy: Decisions and statements from the BoE and BoC can significantly affect the value of both currencies.

The GBPCAD pair can be attractive to both short-term traders, leveraging daily volatility, and long-term investors analyzing fundamental factors influencing the value of both currencies. Understanding how these factors interact is key to effectively trading this currency pair.

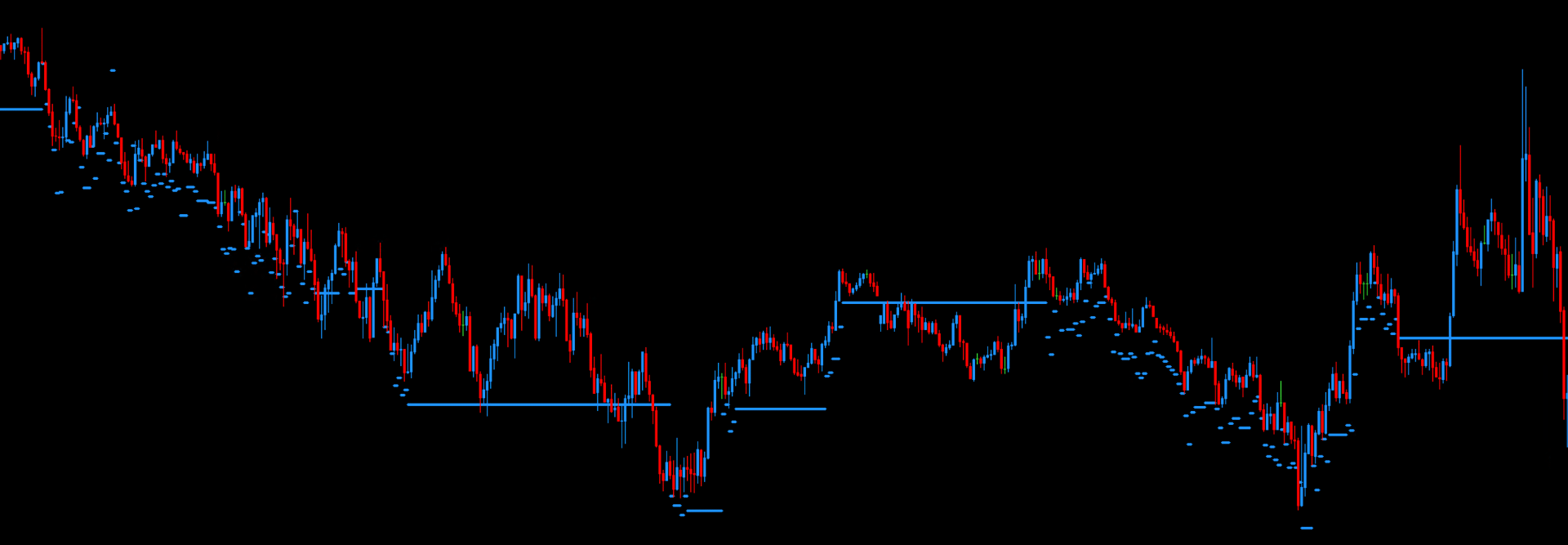

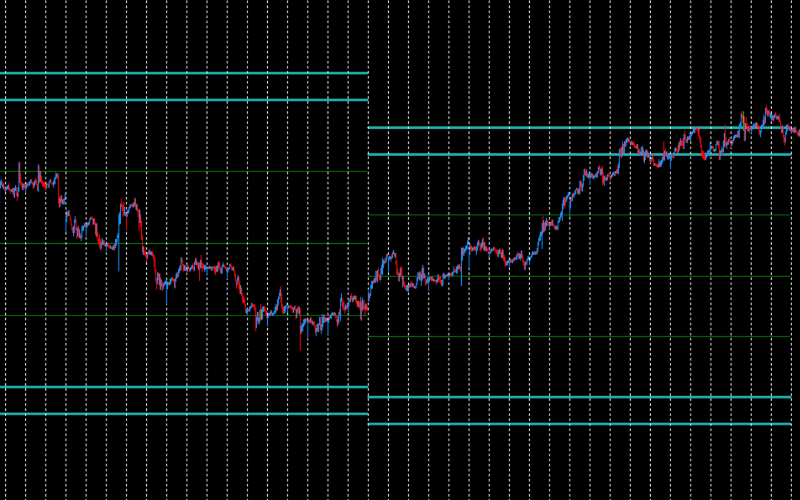

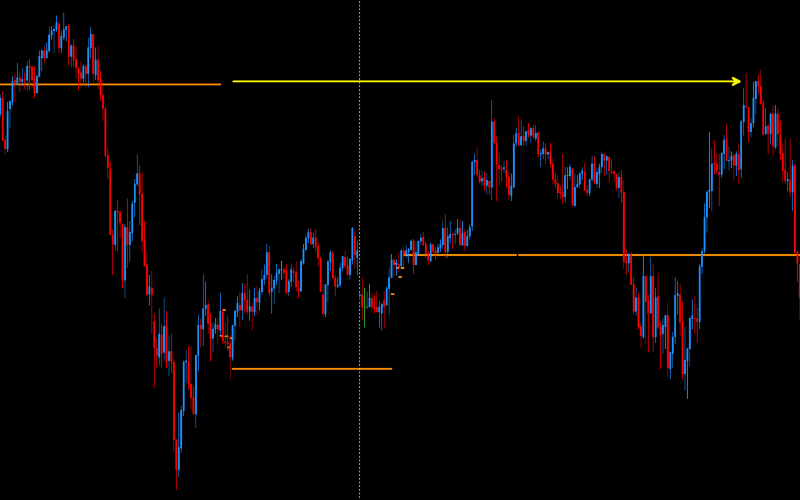

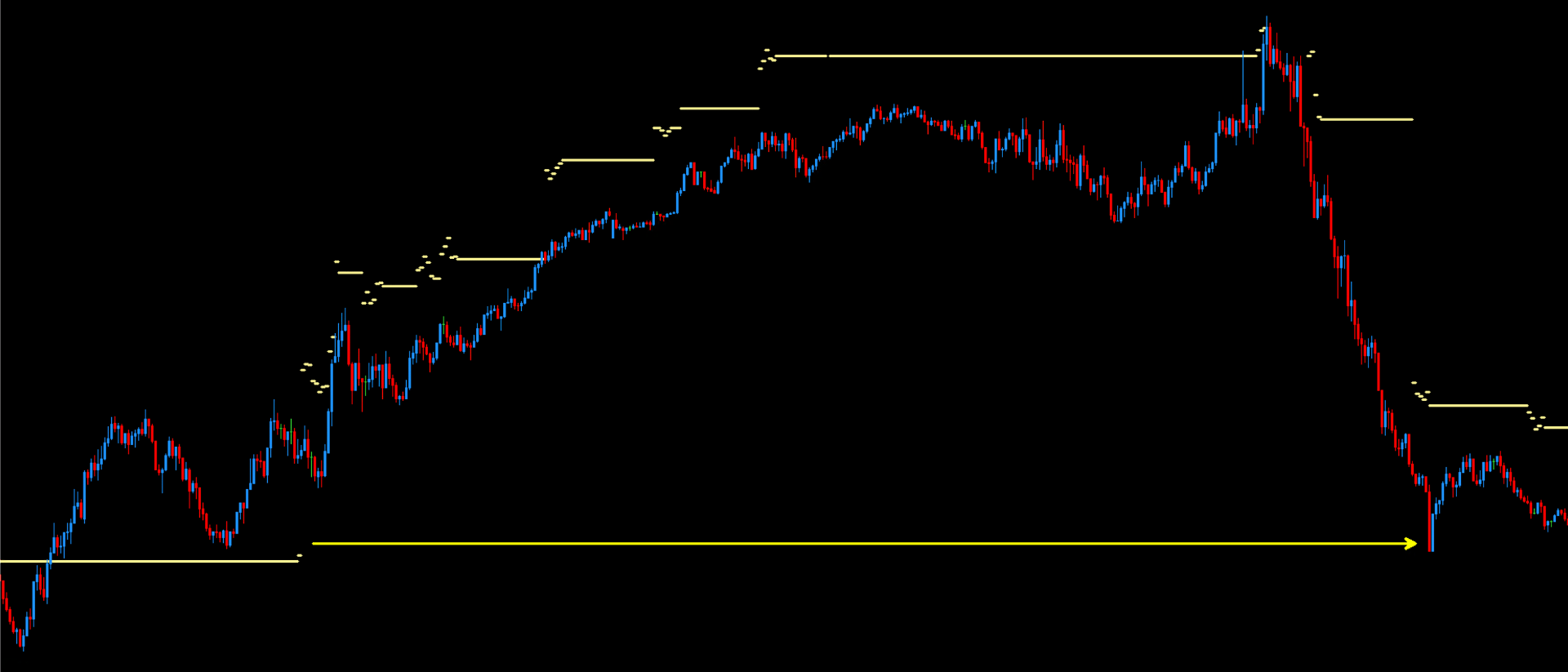

Example DML levels:

SeaGreen - Monthly Support & Resistance

SeaGreen levels are monthly supports and resistances set at the beginning of each calendar month. The price rarely reaches these levels, but when it does, it usually either changes direction long-term or consolidates at that level. This makes it an ideal level for investors and traders who position their trades over a longer time frame.

You can find more about SeaGreen levels here.

DarkOrange - precise price reactions

DarkOrange levels are closely linked to Violet levels, which are updated every hour, unlike DarkOrange levels, which are updated every 5 minutes. Both the data sources and calculation algorithms are identical. However, the more frequent 5-minute recalculations for DarkOrange levels have allowed the discovery of unique setups and models, as well as the observation of many anomalies unavailable for trading on Violet levels.

You can find more about DarkOrange levels here.

Khaki – Dynamic Supports and Resistances

Khaki levels on EURUSD are key resistance levels that play an important role in trading this currency pair. Exceeding the zone defined by these levels suggests that the price should return to them. Particularly important is the zone between the last Flow Zone (FZ), which appears in the morning, and 11:00 AM GMT. Levels ending after 12:00 PM GMT are also settled, but experience shows that treating Khaki levels as resistances until 11:00 AM is safer and has significantly better repeatability. The repeatability of returns to these levels is over 90%.

You can find more about Khaki levels here.

DodgerBlue - Completed DML Levels

DodgerBlue levels, offered by DeepMarketLevel.com, are a unique tool for analyzing the forex market. Their distinctiveness lies in precisely identifying key price levels that statistical models recognize as significant for price movements within specific timeframes.

You can find more about DodgerBlue levels here.