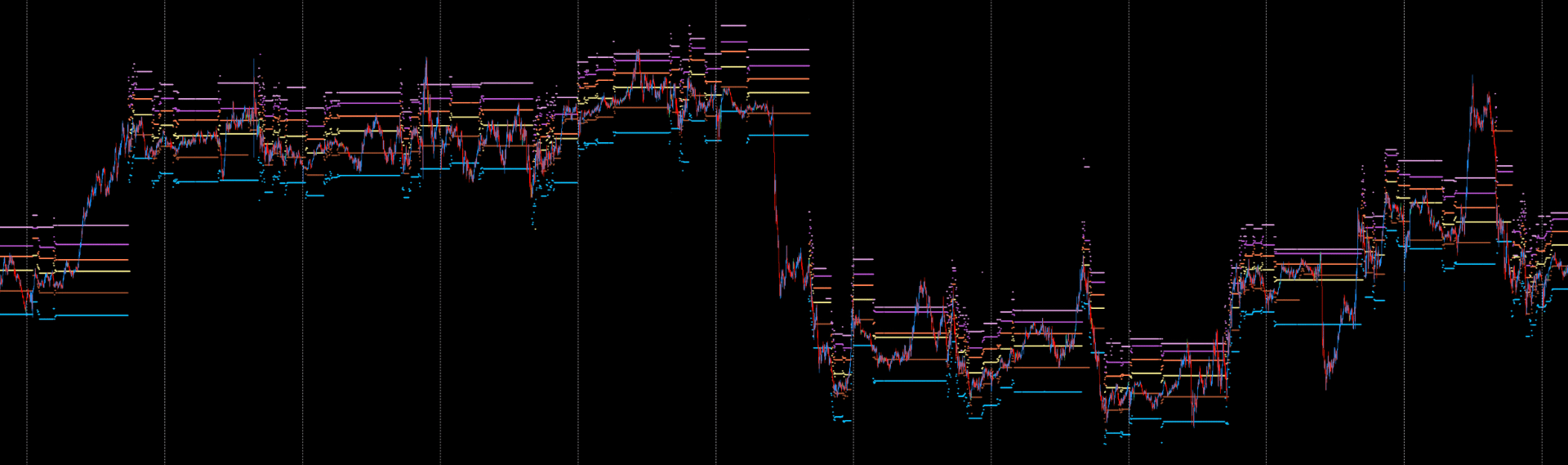

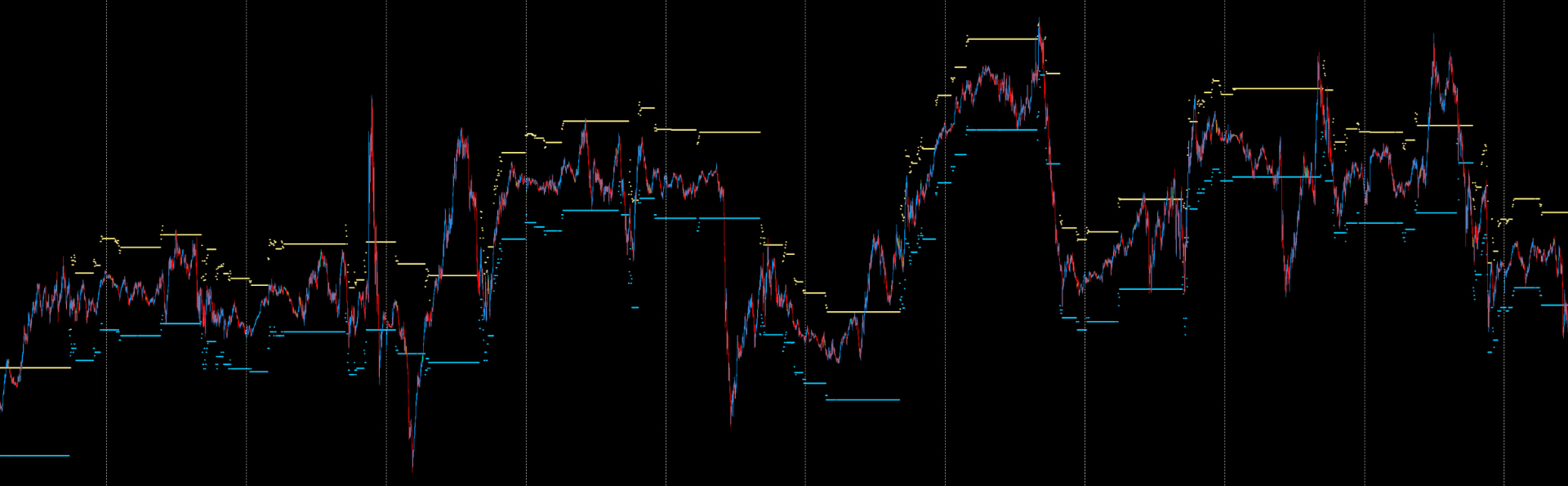

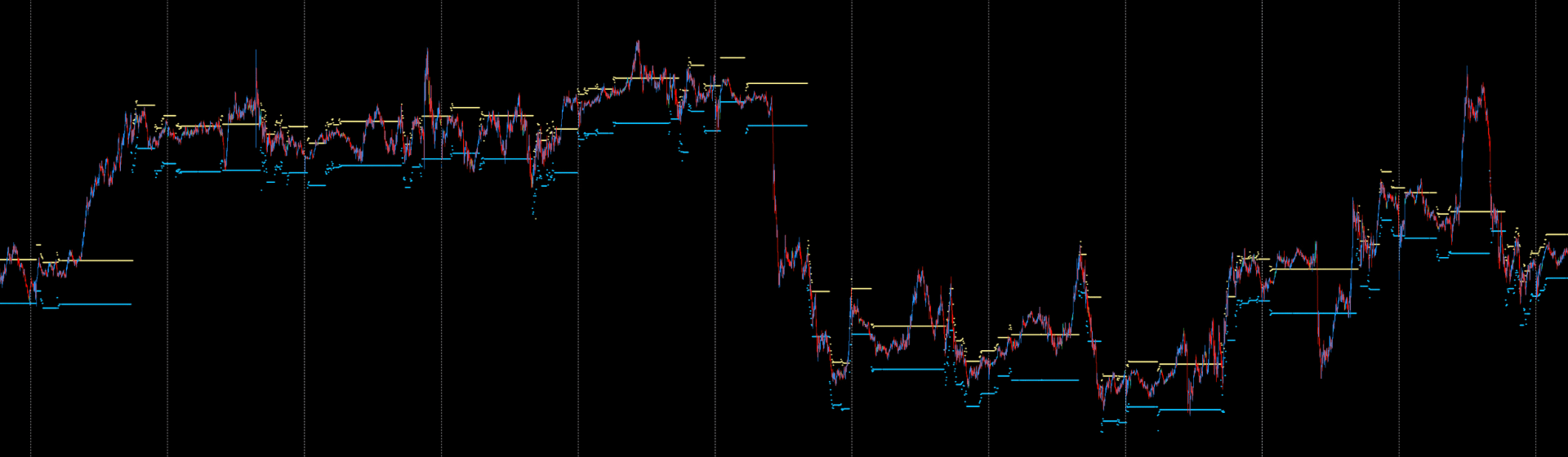

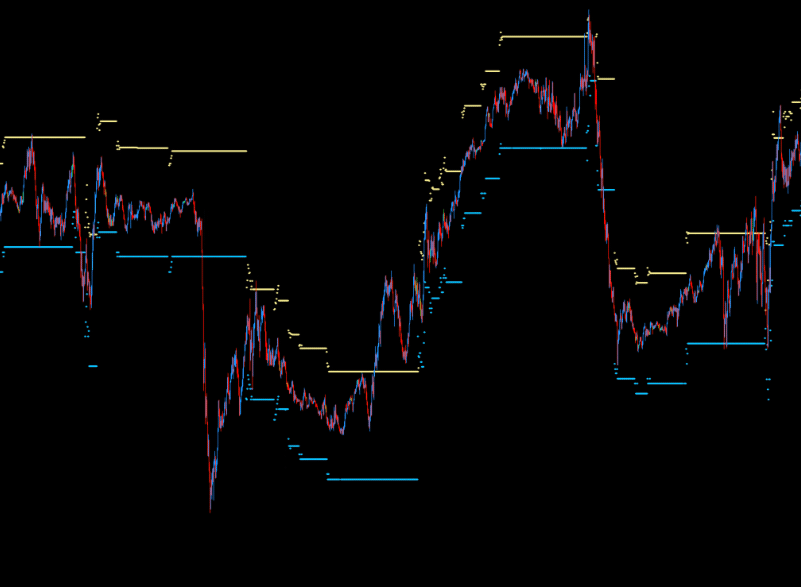

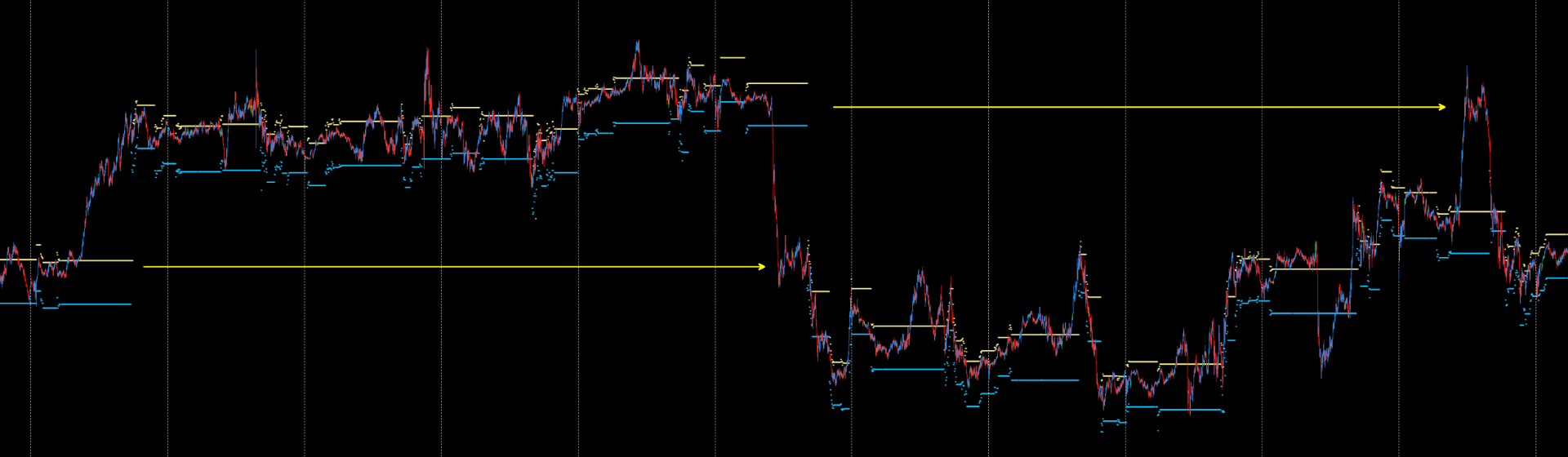

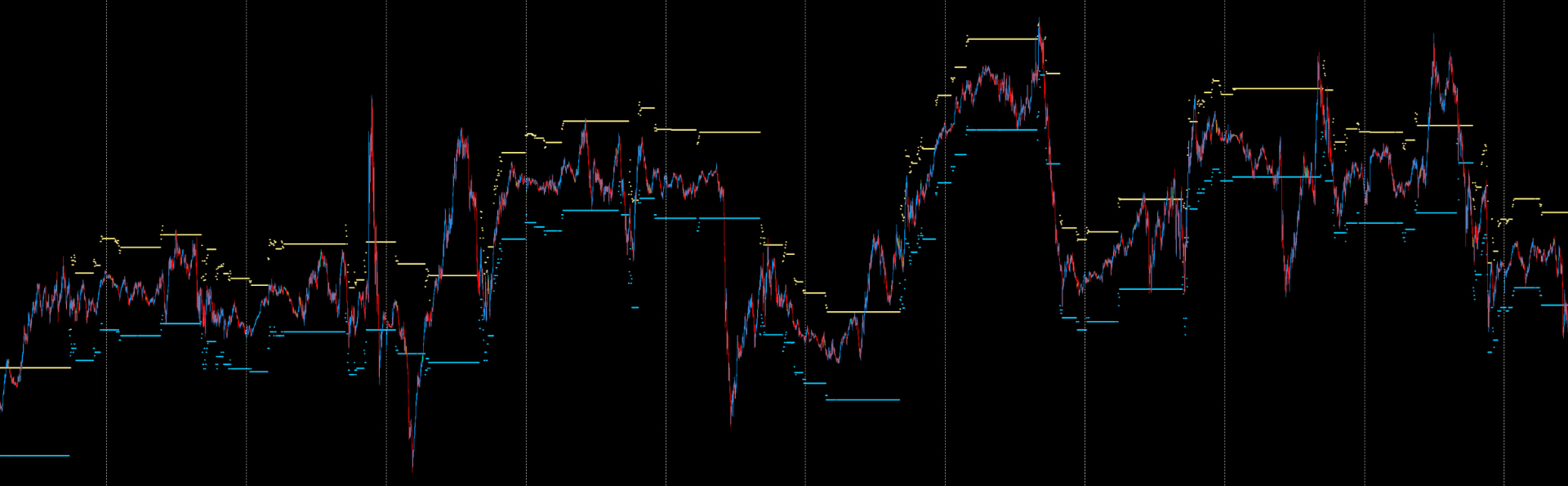

Flow Zone (FZ) Levels

Flow Zone (FZ) levels are liquidity flow-based indicators that serve as key support and resistance levels in the currency market. They are calculated using advanced algorithms that analyze high-value transactions and market dynamics. Due to their precision, FZ levels can be used by traders to identify critical moments in the market where price direction changes are likely to occur.

Characteristics of FZ Levels

Flow Zone (FZ) levels serve two main functions – they can act as support or resistance, depending on the currency pair.

For example:

- DeepSkyBlue (2) levels on currency pairs where USD (the U.S. dollar) is the base currency (e.g., USDCAD, USDCHF, USDJPY) function as support. However, on pairs where USD is the quote currency (e.g., AUDUSD, EURUSD, GBPUSD), these same levels function as resistance.

- Khaki levels work in reverse. On pairs with USD as the base currency, these levels act as resistance, while on pairs with USD as the quote currency, they serve as support.

Note: On currency pairs without USD, Khaki and DeepSkyBlue2 levels also exist, but their function may differ from the one described above.

FZ Levels and Price Zones

Flow Zone levels divide the price chart into several zones:

- BSMZ (Big Smart Money Zone) – a zone lasting several hours, typically from 2-3 GMT until around 13 GMT, just before the U.S. session begins.

- SSMZ (Small Smart Money Zone) – a shorter zone lasting from several minutes to several tens of minutes.

- FZ (Flow Zone) – the liquidity shift zone that exists between BSMZ and SSMZ zones.

Several SSMZ zones can occur within a single trading day, while there is usually only one BSMZ.

Trading Models on FZ Levels

- BSMZ: The optimal time for trading Flow Zone levels within the BSMZ is between 5 and 12 GMT. If the price breaks support or resistance during this period, the model suggests that it should return to the zone before or during the U.S. session.

Sometimes these levels are not settled the same day but after 2-3 days. These levels should be closely monitored, as after settlement, they often become strong reaction levels.

- SSMZ: The price usually leaves the boundaries set by the SSMZ zone only after the zone has ended. If the price exits the SSMZ zone before it ends, the zone is usually retested, just like the BSMZ zone.

- Trading the boundaries of BSMZ and SSMZ zones: Another trading model involves treating the levels that define the boundaries of the BSMZ and SSMZ zones as typical support and resistance levels. It is expected that the price will reverse at these levels. In almost every case, the price should react by a few (or several) pips, creating short-term trading opportunities.

FZ (Flow Zone) Levels

FZ zones appear between the BSMZ and SSMZ zones and are also referred to as liquidity shift zones.

These zones have no clear boundaries – instead, DML levels create a dispersed cloud of short lines. However, the beginning and end levels of these zones are crucial.

There are many levels in the Flow Zone group, and they can have different colors and functions on different currency pairs. Before making any investment decisions, it’s essential to check how a particular level has behaved in the past.