GBPJPY

The GBPJPY currency pair combines the British pound sterling (GBP), the official currency of the United Kingdom, with the Japanese yen (JPY), the currency of Japan. GBPJPY is often referred to as "The Dragon" or "The Beast" due to its high volatility and capacity for significant price movements in a short period. This pair reflects the economic and financial relationship between one of Europe's largest economies and the world's third-largest economy.

Characteristics and Specifics

- High Volatility: GBPJPY is known for substantial price fluctuations, making it attractive to traders seeking potentially high returns. This volatility stems from the dynamic nature of both the British pound and the Japanese yen, which respond to a variety of macroeconomic and geopolitical factors.

- Monetary Policy: Decisions by the Bank of England (BoE) and the Bank of Japan (BoJ) regarding interest rates and monetary policy significantly impact the GBPJPY exchange rate. Differences in the central banks' approaches to inflation, economic growth, and financial stability can lead to considerable movements in this currency pair.

- Risk Appetite: The Japanese yen is considered a safe-haven currency. During periods of global uncertainty, investors often shift capital into the yen, potentially causing the GBPJPY rate to fall. Conversely, wh_en markets are optimistic, investors may sell the yen in favor of riskier assets like the British pound.

- Macroeconomic Data: Releases of key economic indicators such as GDP, inflation, employment, and industrial production from the UK and Japan directly affect the value of both currencies. Particular attention should be paid to data concerning the UK's financial sector and Japan's export situation.

- Impact of Geopolitical Events: Events such as trade negotiations, international tensions, or political changes can influence the GBPJPY exchange rate. For instance, the Brexit process introduced significant volatility to the GBP.

Summary

GBPJPY offers significant trading opportunities due to its volatility and sensitivity to a wide range of economic and political factors. However, this volatility also entails increased risk, making robust risk management strategies essential.

- Central Bank Decisions: Regularly follow announcements and decisions from the BoE and BoJ regarding monetary policy.

- Macroeconomic Data: Analyze economic releases from both countries to anticipate potential exchange rate movements.

- Global Market Sentiment: Observe investor risk appetite, which can influence demand for the yen as a safe-haven currency.

- Geopolitical Events: Stay informed about significant political and economic events worldwide that could impact the GBPJPY rate.

The GBPJPY pair can be appealing to experienced traders who can harness its volatility, but it requires caution and a deep understanding of the factors influencing its price movements.

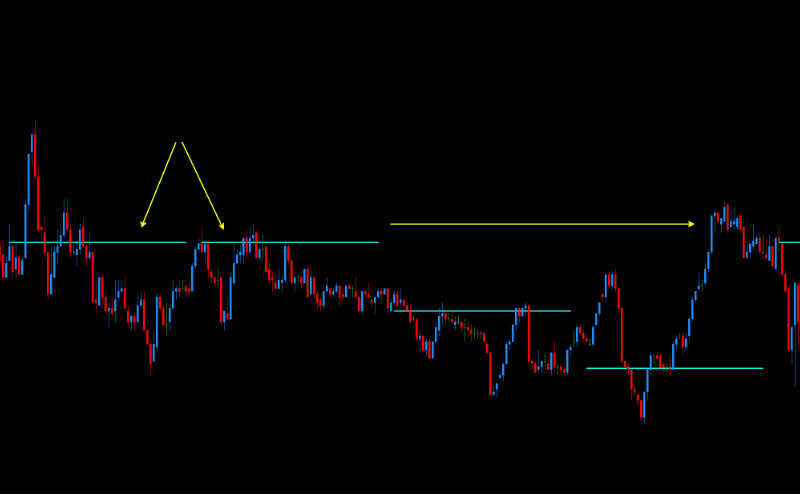

Example DML levels:

SeaGreen - Monthly Support & Resistance

SeaGreen levels are monthly supports and resistances set at the beginning of each calendar month. The price rarely reaches these levels, but when it does, it usually either changes direction long-term or consolidates at that level. This makes it an ideal level for investors and traders who position their trades over a longer time frame.

You can find more about SeaGreen levels here.

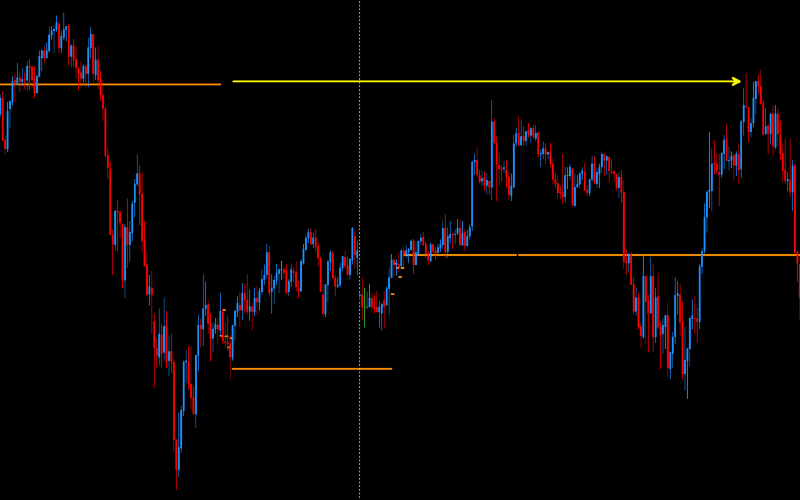

DarkOrange - precise price reactions

DarkOrange levels are closely linked to Violet levels, which are updated every hour, unlike DarkOrange levels, which are updated every 5 minutes. Both the data sources and calculation algorithms are identical. However, the more frequent 5-minute recalculations for DarkOrange levels have allowed the discovery of unique setups and models, as well as the observation of many anomalies unavailable for trading on Violet levels.

You can find more about DarkOrange levels here.

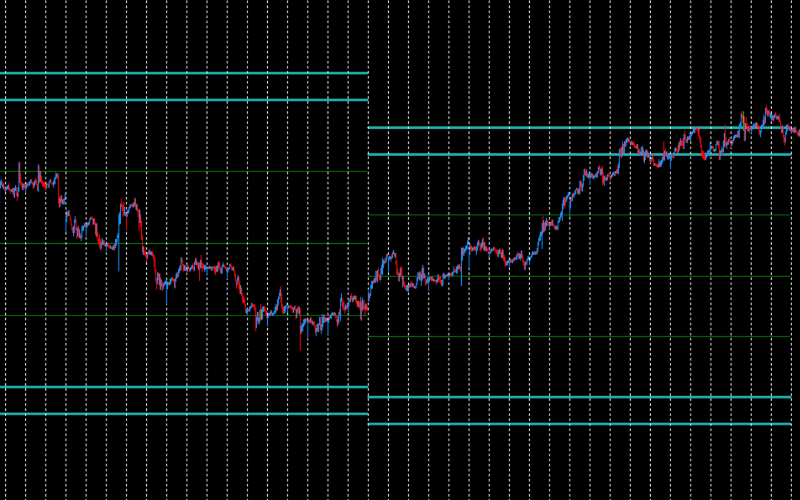

Aqua - DML Floating Levels

Aqua levels, similar to Violet levels, are retrieved every hour, although their characteristics are quite different. Violet levels, for reference, typically hold one level throughout most of the day, then shift to a new level in the evening after the Flow Zone (FZ). In contrast, Aqua levels usually appear near the current price level.

You can find more about Aqua levels here.

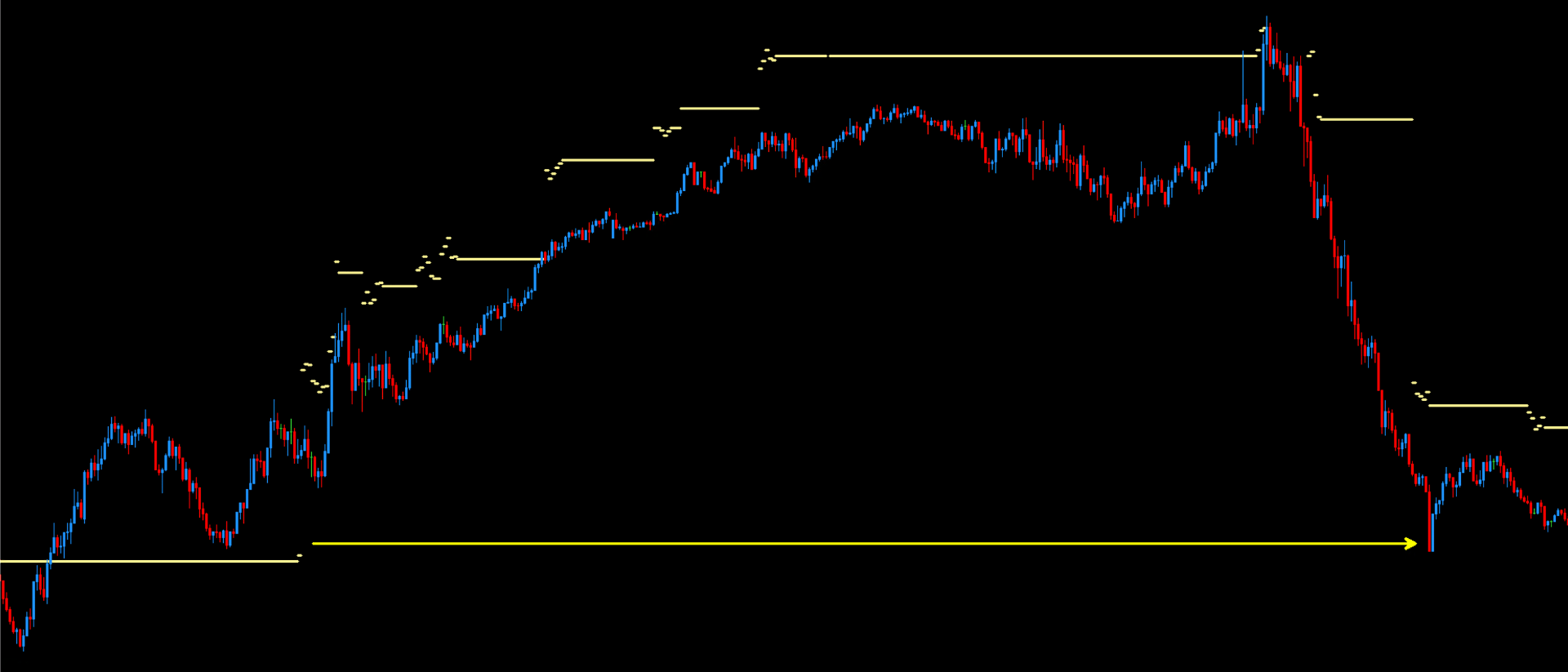

Khaki – Dynamic Supports and Resistances

Khaki levels on EURUSD are key resistance levels that play an important role in trading this currency pair. Exceeding the zone defined by these levels suggests that the price should return to them. Particularly important is the zone between the last Flow Zone (FZ), which appears in the morning, and 11:00 AM GMT. Levels ending after 12:00 PM GMT are also settled, but experience shows that treating Khaki levels as resistances until 11:00 AM is safer and has significantly better repeatability. The repeatability of returns to these levels is over 90%.

You can find more about Khaki levels here.