USDCHF

The USDCHF currency pair combines the United States dollar (USD), the official currency of the United States, with the Swiss franc (CHF), the currency of Switzerland. USDCHF is considered one of the major pairs in the Forex market. The Swiss franc is often viewed as a "safe-haven" currency due to Switzerland's political and economic stability and its neutrality in international conflicts.

Characteristics and Specifics

- Monetary Policy: Decisions by the U.S. Federal Reserve (Fed) and the Swiss National Bank (SNB) regarding interest rates and monetary policy significantly impact the USDCHF exchange rate. The SNB is known for intervening in the foreign exchange market to weaken the franc to prevent excessive currency appreciation that could harm Swiss exports.

- Safe-Haven Currency: During times of global economic or political uncertainty, investors often turn to the Swiss franc, leading to its appreciation. This can cause the USDCHF exchange rate to decline as CHF gains value against USD.

- Macroeconomic Data: Releases of key economic indicators such as GDP, inflation, unemployment rates, and trade balances from the U.S. and Switzerland affect the value of both currencies. However, due to the larger size of the U.S. economy, data from the U.S. often have a stronger impact on the USDCHF rate.

- SNB Interventions: The Swiss National Bank has frequently taken actions to control the value of the franc through market interventions or adjusting interest rates. Such actions can lead to sudden and significant movements in the USDCHF pair.

- Global Market Sentiment: Volatility in this pair is often linked to overall investor sentiment in global financial markets. Increased risk aversion can lead to CHF strengthening, while increased risk appetite may weaken the franc in favor of the U.S. dollar.

Summary

USDCHF offers traders opportunities arising from differences in monetary policy, macroeconomic data, and global market sentiment.

- Central Bank Decisions: Keeping track of announcements and actions by the Fed and SNB, including interest rate changes and potential currency interventions.

- Macroeconomic Data: Regular analysis of economic indicators from the U.S. and Switzerland that can influence the strength of both currencies.

- Global Events: Observing geopolitical and economic developments worldwide that may affect investor risk appetite and demand for safe-haven currencies.

The USDCHF pair can be attractive to both short-term traders, capitalizing on volatility from current events, and long-term investors focusing on fundamental economic and political trends.

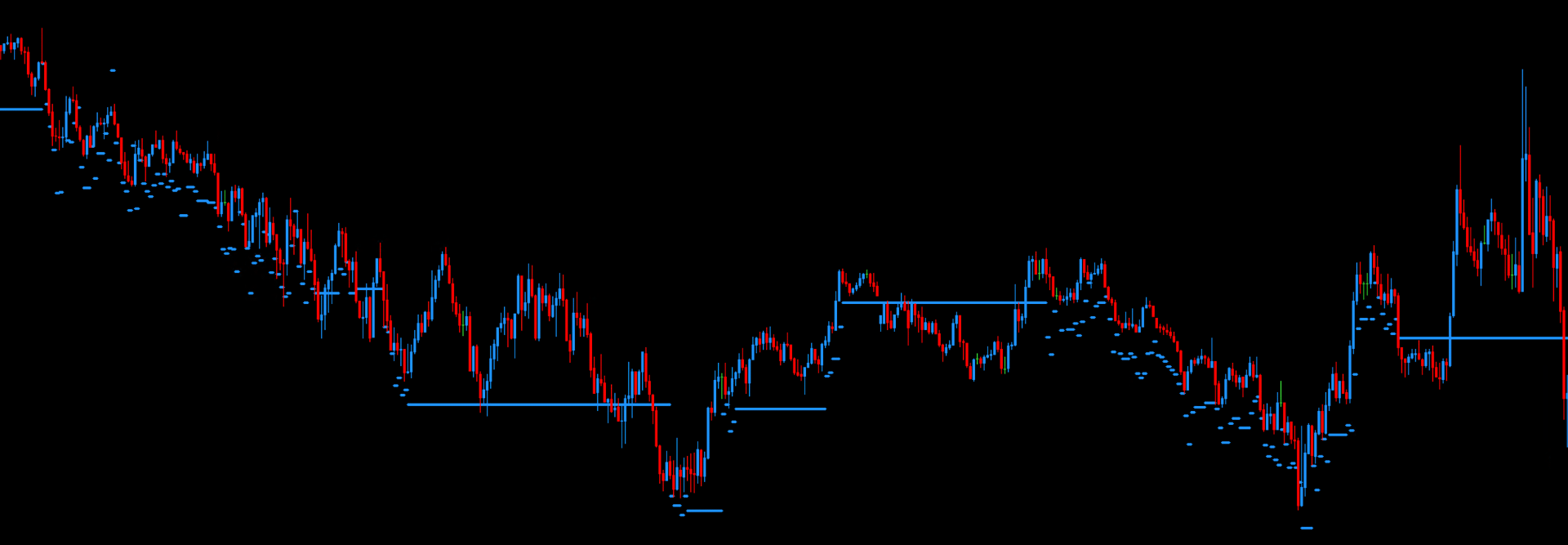

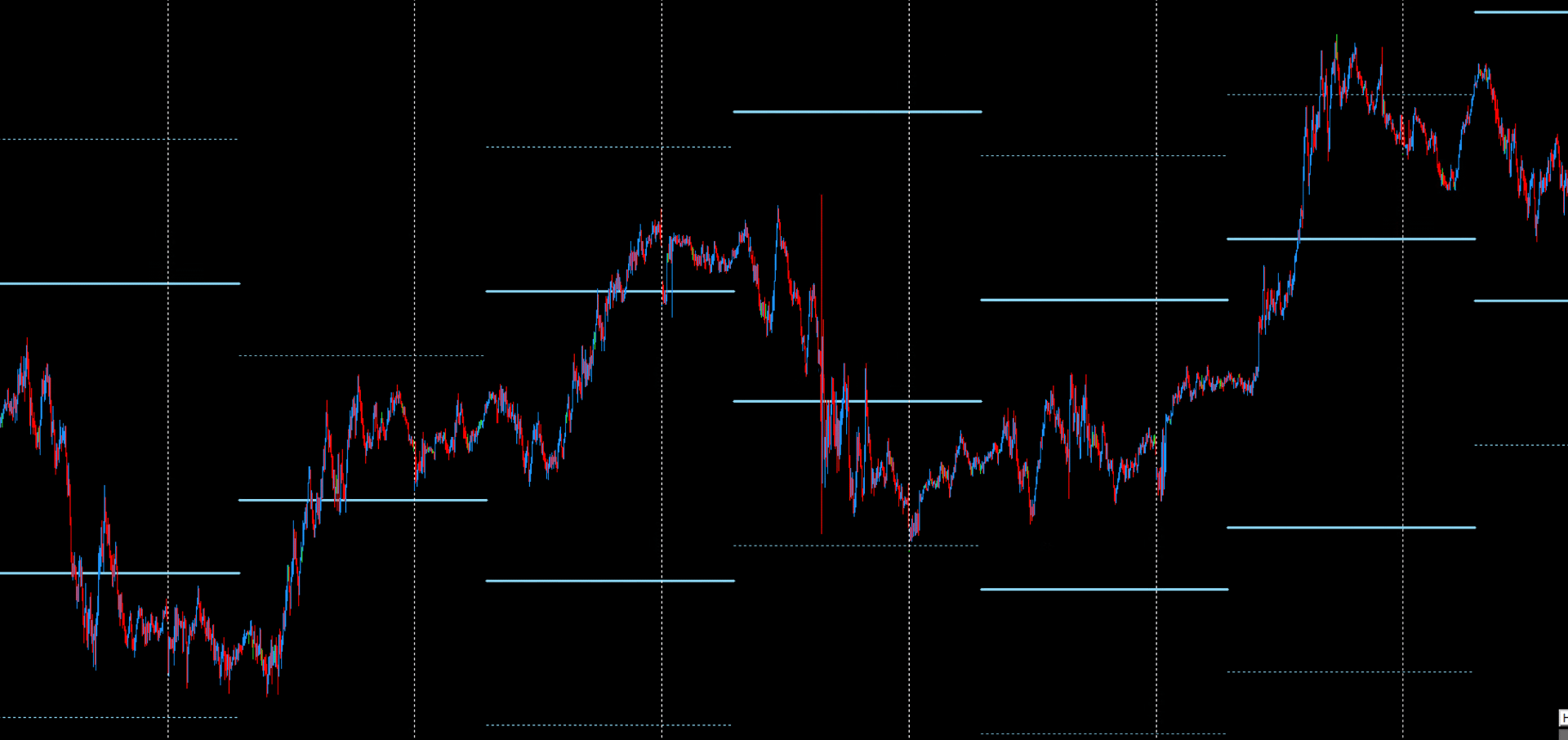

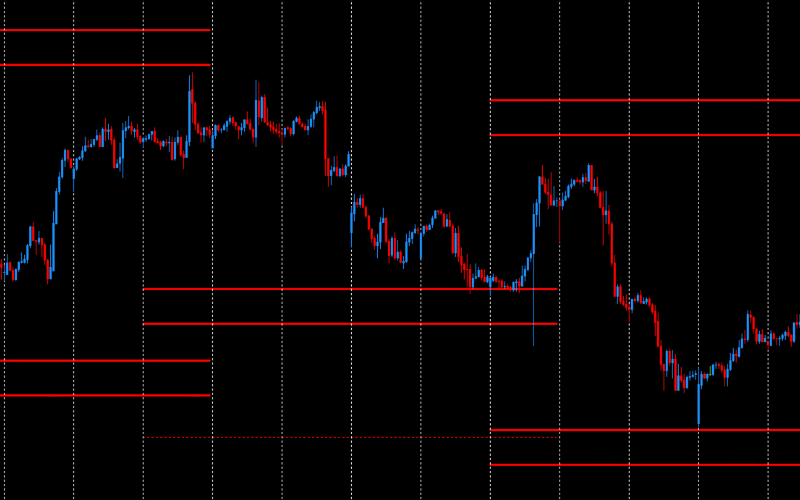

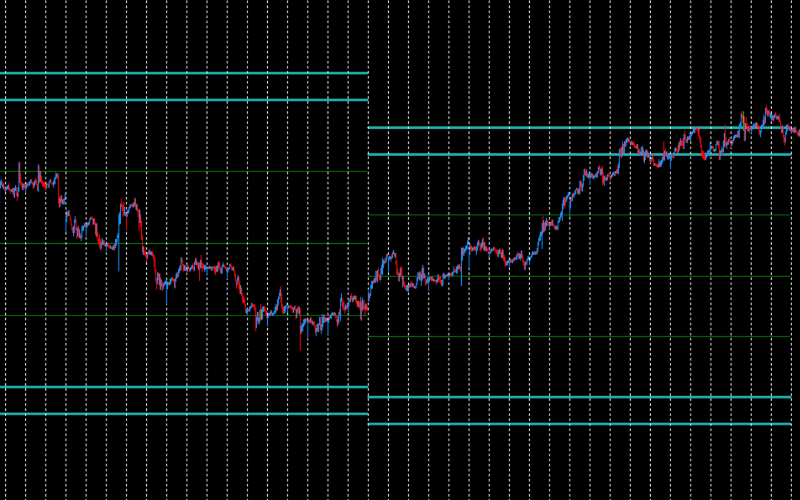

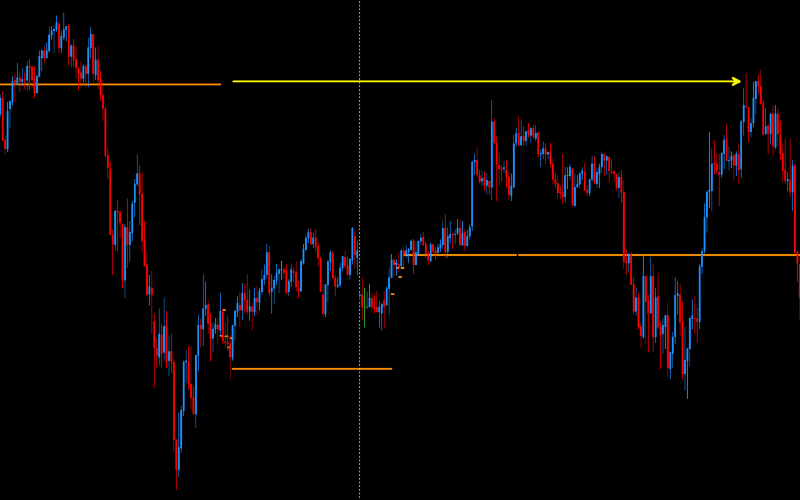

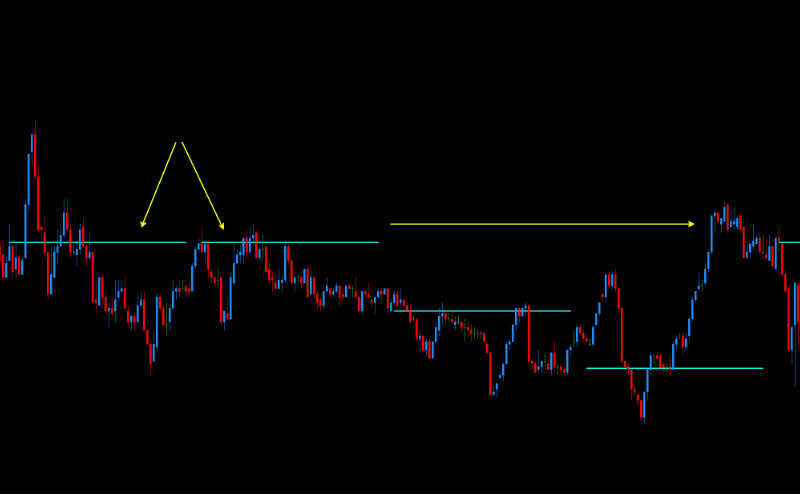

Example DML levels:

SkyBlue - Daily Support & Resistance

The SkyBlue levels are daily support and resistance levels published around 6:00 AM GMT. These levels are determined based on liquidity flow analysis and key market data, serving as a tool for identifying short-term price movements.

You can find more about SkyBlue levels here.

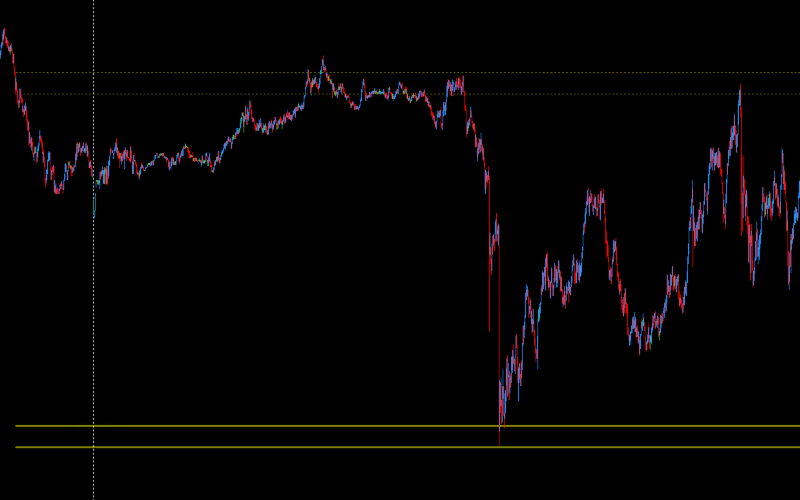

Red - Weekly Support & Resistance

The Red levels are weekly supports and resistances. They appear on the chart on Wednesday afternoons and remain valid for the following week. Red levels consist of a total of six horizontal lines: three above the price and three below. The main Red levels, known as RedEx, are located at the extreme positions - both at the bottom and top. Approximately one-quarter of the distance between the lower and upper RedEx levels, the Red levels create a zone marked by two bold lines, both above and below the price.

You can find more about Red levels here.

SeaGreen - Monthly Support & Resistance

SeaGreen levels are monthly supports and resistances set at the beginning of each calendar month. The price rarely reaches these levels, but when it does, it usually either changes direction long-term or consolidates at that level. This makes it an ideal level for investors and traders who position their trades over a longer time frame.

You can find more about SeaGreen levels here.

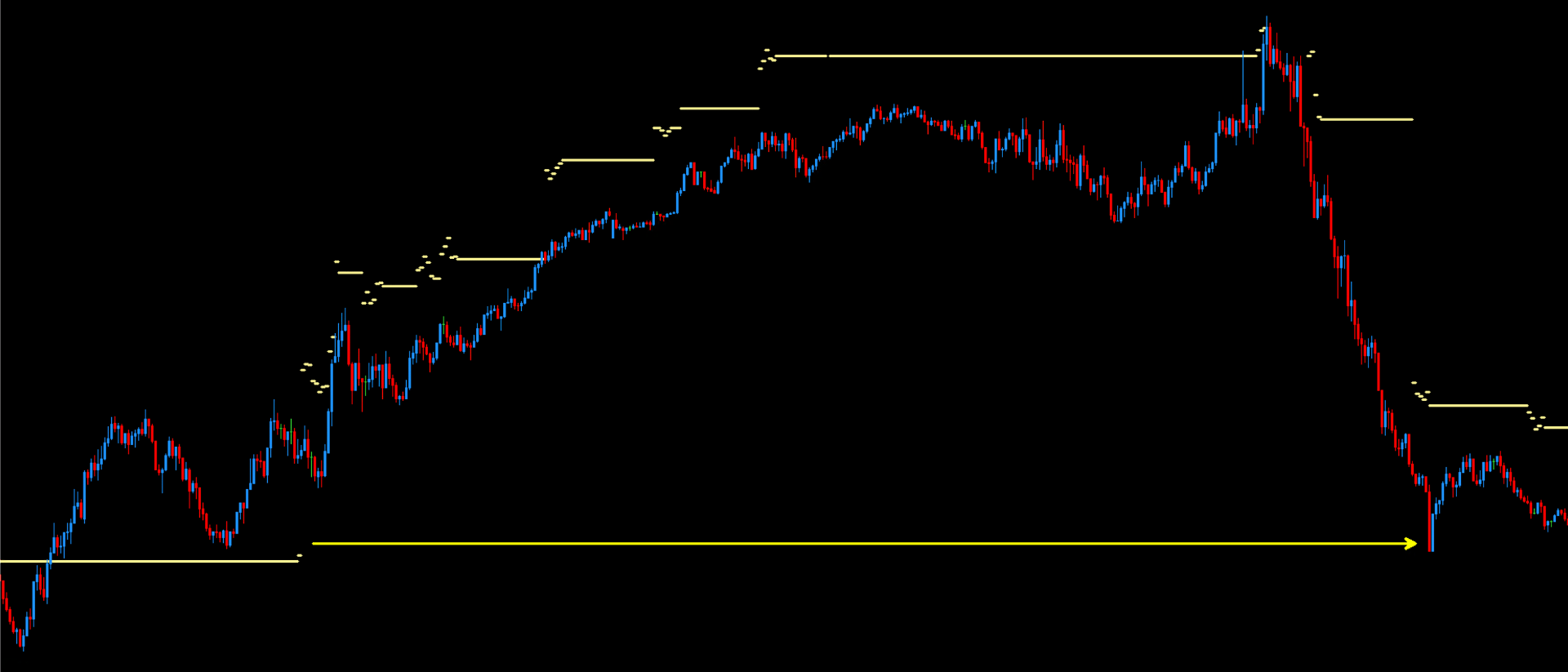

DarkOrange - precise price reactions

DarkOrange levels are closely linked to Violet levels, which are updated every hour, unlike DarkOrange levels, which are updated every 5 minutes. Both the data sources and calculation algorithms are identical. However, the more frequent 5-minute recalculations for DarkOrange levels have allowed the discovery of unique setups and models, as well as the observation of many anomalies unavailable for trading on Violet levels.

You can find more about DarkOrange levels here.

Aqua - DML Floating Levels

Aqua levels, similar to Violet levels, are retrieved every hour, although their characteristics are quite different. Violet levels, for reference, typically hold one level throughout most of the day, then shift to a new level in the evening after the Flow Zone (FZ). In contrast, Aqua levels usually appear near the current price level.

You can find more about Aqua levels here.

Olive - Daily Support and Resistance

Olive levels are generated once a day, around 19:00 GMT. This level consists of three zones. The middle zone is located around the price level at 19:00 GMT. The other two zones are located above and below the middle zone, at equal distances from it. The range of these distances varies daily and indicates the potential movement dynamics for the next day. The lower zone is a very strong support for the next trading day, while the upper zone is a strong resistance for the next trading day.

You can find more about Olive levels here.

Khaki – Dynamic Supports and Resistances

Khaki levels on EURUSD are key resistance levels that play an important role in trading this currency pair. Exceeding the zone defined by these levels suggests that the price should return to them. Particularly important is the zone between the last Flow Zone (FZ), which appears in the morning, and 11:00 AM GMT. Levels ending after 12:00 PM GMT are also settled, but experience shows that treating Khaki levels as resistances until 11:00 AM is safer and has significantly better repeatability. The repeatability of returns to these levels is over 90%.

You can find more about Khaki levels here.

DodgerBlue - Completed DML Levels

DodgerBlue levels, offered by DeepMarketLevel.com, are a unique tool for analyzing the forex market. Their distinctiveness lies in precisely identifying key price levels that statistical models recognize as significant for price movements within specific timeframes.

You can find more about DodgerBlue levels here.