EURCAD

Trading the EURCAD pair is characterized by a specific dynamic resulting from the differences in the monetary policies of the European Central Bank (ECB) and the Bank of Canada (BoC). Additionally, the value of this currency pair is influenced by macroeconomic factors such as industrial production data, inflation, employment, and changes in commodity prices, particularly oil, of which Canada is one of the major exporters.

EURCAD Characteristics

The EURCAD currency pair, consisting of the euro (EUR) and the Canadian dollar (CAD), is an interesting trading instrument in the Forex market. The euro, the official currency of the Eurozone, is used by most of the European Union member states, making it one of the most important currencies in the world. The Canadian dollar, on the other hand, is the currency of Canada, a country with a stable economy rich in natural resources such as oil and natural gas.

This is a cross-currency pair, meaning it does not include the US dollar, which often serves as an intermediary currency in foreign exchange transactions.

The exchange rate of this pair is sensitive to many factors, including the monetary policy decisions of the European Central Bank (ECB) and the Bank of Canada (BoC), as well as changes in the economies of both regions. Commodity prices, especially oil, which is a key export commodity for Canada, also have a significant impact.

The specificity of the EURCAD pair lies in its combination of an economy oriented towards services and manufacturing (Eurozone) with an economy largely based on natural resources (Canada). This makes the pair exhibit interesting behaviors in different phases of the economic cycle and in response to global economic events.

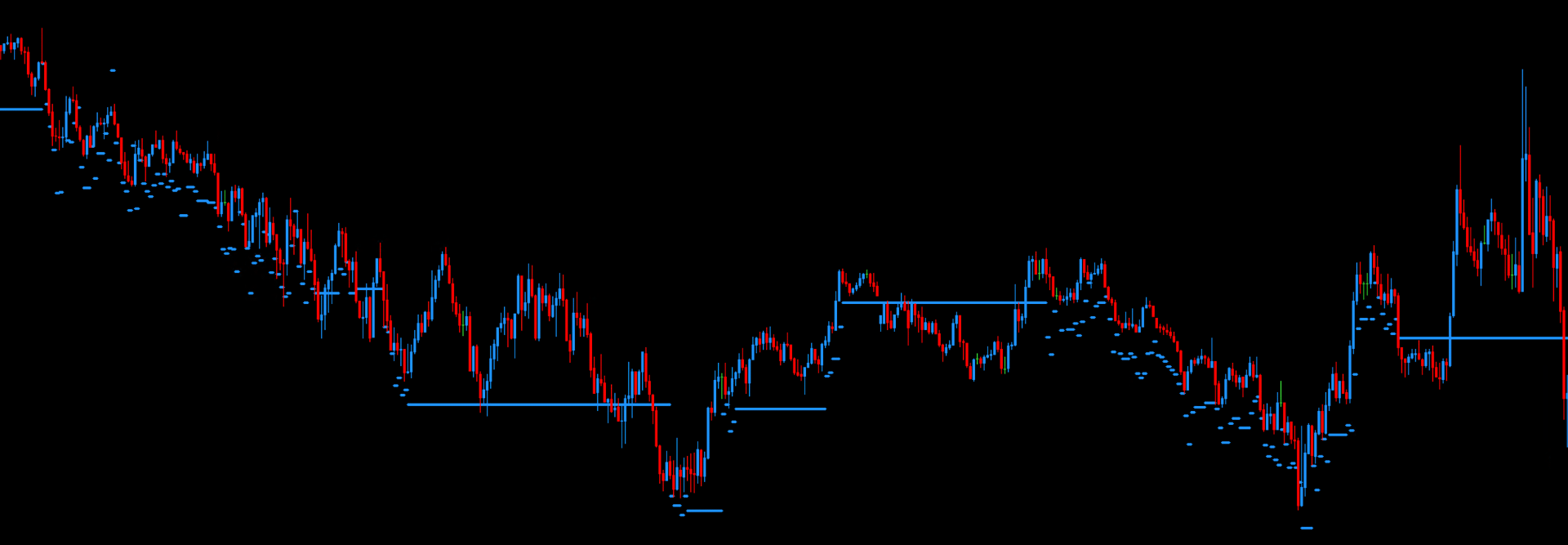

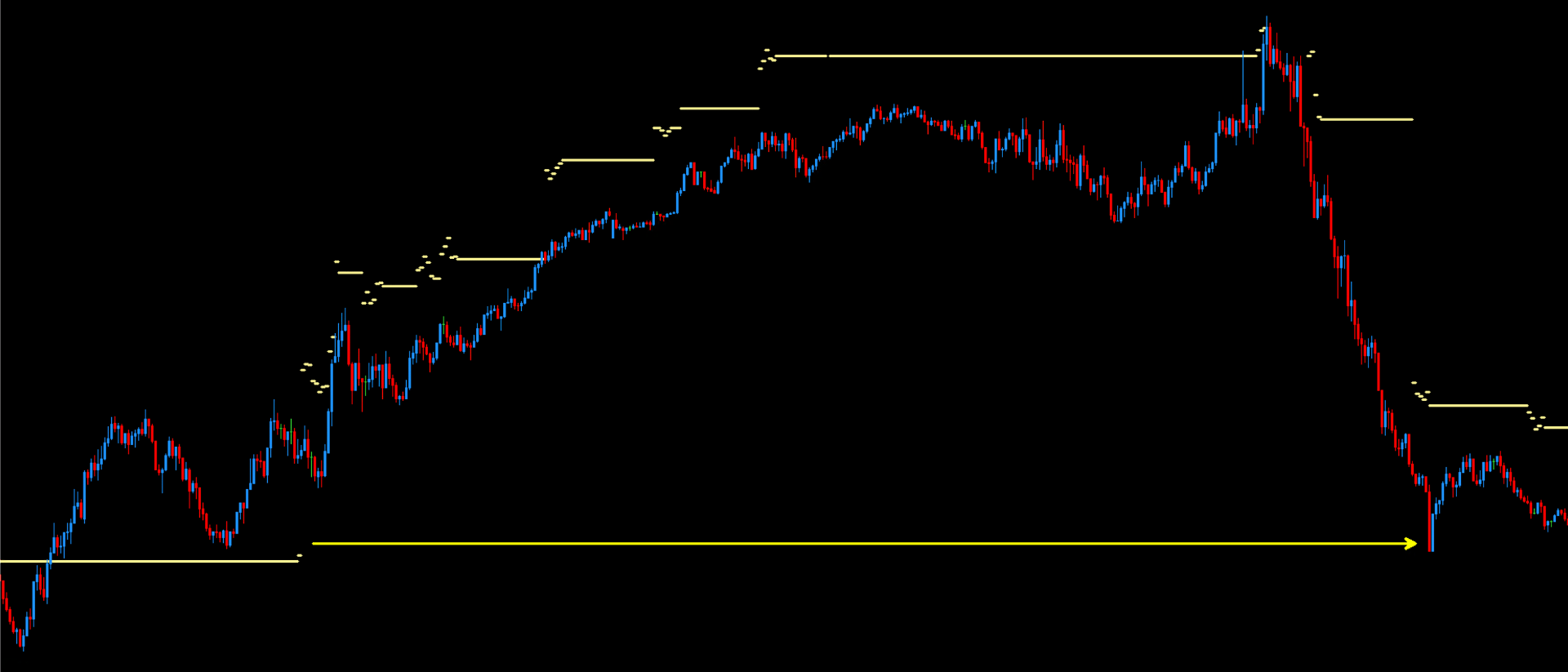

DML Price Levels for EURCAD

The DML offering for the EURCAD pair includes several key price levels.

These levels are crucial for traders using both scalping and swing trading strategies.

In scalping, these levels can serve as precise entry and exit points in short-term transactions, often lasting from a few minutes to a few hours.

For swing traders, DML levels can be used to identify potential turning points or areas of support and resistance in a longer time frame, spanning days or even weeks.

Summary

The EURCAD currency pair offers a wide range of investment opportunities due to its specific dynamics and macroeconomic influences.

With the key DML price levels, traders have access to advanced analytical tools that support them in making more informed and effective trading decisions.

These levels can serve as reference points for setting target levels (TakeProfit), stop loss levels, or identifying potential areas of accumulation or distribution in the EURCAD currency pair.

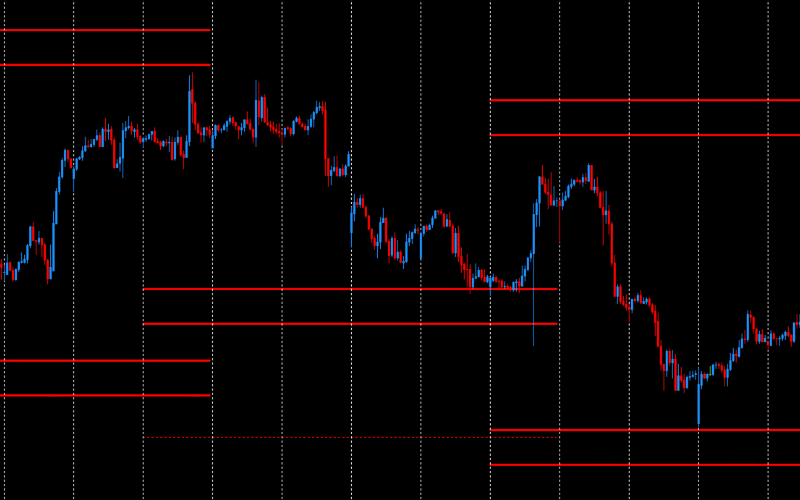

Example DML levels:

Red - Weekly Support & Resistance

The Red levels are weekly supports and resistances. They appear on the chart on Wednesday afternoons and remain valid for the following week. Red levels consist of a total of six horizontal lines: three above the price and three below. The main Red levels, known as RedEx, are located at the extreme positions - both at the bottom and top. Approximately one-quarter of the distance between the lower and upper RedEx levels, the Red levels create a zone marked by two bold lines, both above and below the price.

You can find more about Red levels here.

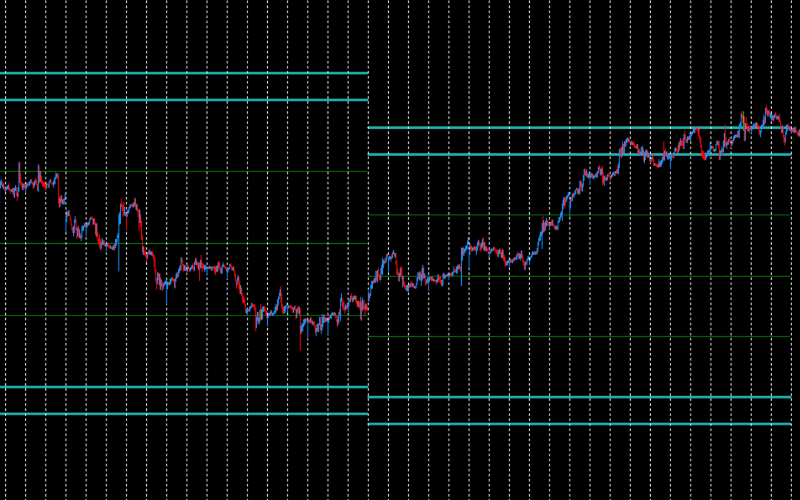

SeaGreen - Monthly Support & Resistance

SeaGreen levels are monthly supports and resistances set at the beginning of each calendar month. The price rarely reaches these levels, but when it does, it usually either changes direction long-term or consolidates at that level. This makes it an ideal level for investors and traders who position their trades over a longer time frame.

You can find more about SeaGreen levels here.

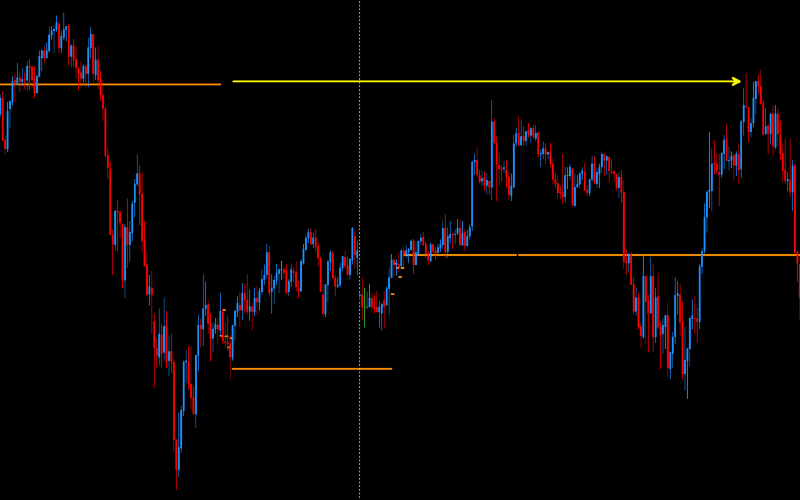

DarkOrange - precise price reactions

DarkOrange levels are closely linked to Violet levels, which are updated every hour, unlike DarkOrange levels, which are updated every 5 minutes. Both the data sources and calculation algorithms are identical. However, the more frequent 5-minute recalculations for DarkOrange levels have allowed the discovery of unique setups and models, as well as the observation of many anomalies unavailable for trading on Violet levels.

You can find more about DarkOrange levels here.

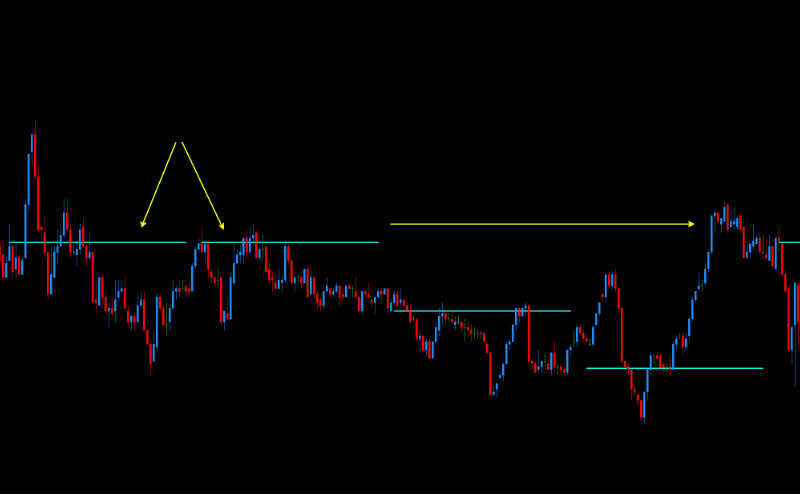

Aqua - DML Floating Levels

Aqua levels, similar to Violet levels, are retrieved every hour, although their characteristics are quite different. Violet levels, for reference, typically hold one level throughout most of the day, then shift to a new level in the evening after the Flow Zone (FZ). In contrast, Aqua levels usually appear near the current price level.

You can find more about Aqua levels here.

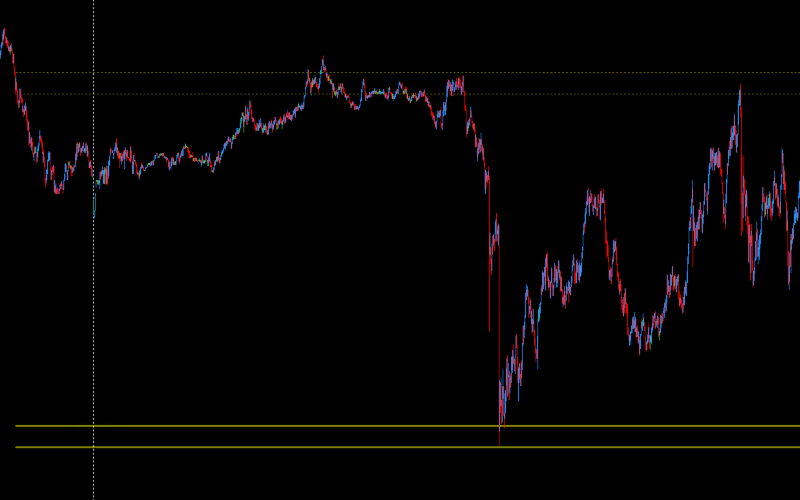

Olive - Daily Support and Resistance

Olive levels are generated once a day, around 19:00 GMT. This level consists of three zones. The middle zone is located around the price level at 19:00 GMT. The other two zones are located above and below the middle zone, at equal distances from it. The range of these distances varies daily and indicates the potential movement dynamics for the next day. The lower zone is a very strong support for the next trading day, while the upper zone is a strong resistance for the next trading day.

You can find more about Olive levels here.

Khaki – Dynamic Supports and Resistances

Khaki levels on EURUSD are key resistance levels that play an important role in trading this currency pair. Exceeding the zone defined by these levels suggests that the price should return to them. Particularly important is the zone between the last Flow Zone (FZ), which appears in the morning, and 11:00 AM GMT. Levels ending after 12:00 PM GMT are also settled, but experience shows that treating Khaki levels as resistances until 11:00 AM is safer and has significantly better repeatability. The repeatability of returns to these levels is over 90%.

You can find more about Khaki levels here.

DodgerBlue - Completed DML Levels

DodgerBlue levels, offered by DeepMarketLevel.com, are a unique tool for analyzing the forex market. Their distinctiveness lies in precisely identifying key price levels that statistical models recognize as significant for price movements within specific timeframes.

You can find more about DodgerBlue levels here.