DML has updated its visualization system for Multilevel groups (SkyBlue, Red, Olive) to enhance chart clarity. The new "one color = one function" rule introduces unique colors like Cyan, Fuchsia, and Tan to distinguish base levels from extensions and outer boundaries. The update is live for all currency pairs. Furthermore, new versions of DML indicators and EAs will now feature customizable line lengths for each color, providing traders with unprecedented workspace personalization.

News

Our news section is a comprehensive knowledge hub for anyone looking to unlock the full potential of DML levels. Here you will find everything you need to deepen your understanding of the markets and refine your trading strategies. Don't let any valuable information slip by. Subscribe to our newsletter to receive notifications about new articles and updates directly to your inbox. It's the best way to always stay one step ahead!

We have implemented the target DML data model. Naming is now unified (e.g., Violet is now DarkOrange) and graphics refreshed (e.g., SkyBlue). New indicators with an individual key option are available in the Client Panel. Updating is recommended to build trading advantages using precise data.

DeepMarketLevel announces major level consolidation, merging multiple DML levels into a streamlined structure. The update shifts to 1-minute interval calculations and enables AI-powered notifications. Migration scheduled for late 2025 and early January 2026, with work performed on weekends to minimize disruption.

DeepMarketLevel introduces version 29.00 of its trading assistant, revolutionizing manual pyramiding management and MMD cloud-based Trailing Stop. The update also includes advanced Break Even features and an improved control panel with transaction history visualization.

We are excited to release the latest version of our semi-automatic EA, revolutionizing grid and pyramid trading. This tool manages an entire set of positions as a single "setup," automatically handling a common, averaged Stop Loss and Take Profit. The trader simply "arms" a DML level or configures the entry conditions, and the EA handles the scanning, execution, and management.

Jim Simons' legendary Medallion Fund is a closed "black box" based on Big Data. Deep Market Level (DML) offers a glimpse into this philosophy. DML levels are not subjective analysis, but objective, algorithmic zones calculated from thousands of sources. Created by Mariusz Maciej Drozdowski's research team (MMD methodology), they focus on Forex – the "global accounting firm." Available with free tools, they help build a market edge "one small spoonful at a time."

Announcing the last in-person DeepMarketLevel workshops of 2025. Two exclusive, all-day meetings will take place in November in Warsaw (Nov 22) and Tricity (Nov 29), focusing on practical trading and identifying capital accumulation zones. Due to the intimate formula and focus on quality, spots are strictly limited to 15 participants per event.

Deep Market Level Limited is launching a public trading experiment, starting this Thursday at 19:00 (GMT+3) on the "Rynki na poziomie" YouTube channel. Led by CEO Mariusz Maciej Drozdowski, the project will openly test a repetitive, semi-automated scalping model based on the unique, mathematical Sienna3 and Sienna4 levels. Participants can observe and test the model on 7 major currency pairs. The initiative aims to transparently verify the effectiveness of DML's proprietary methodology, which is not based on standard technical analysis. A special product offer for participants and a 50% discount on the full Sienna package are available.

The EURUSD currency pair is retesting a key price zone identified by the proprietary Sienna levels from the DeepMarketLevel.com platform. This same area preceded a dynamic rally last Friday. DML's analysis points to a potential retest and a unique anomaly associated with Sienna levels, suggesting that such price returns hold special significance. The situation is being closely watched, as DML's methodology, based on mathematical models rather than classical technical analysis, provides a non-standard perspective on the market.

DeepMarketLevel.com has launched a new "News" section, providing current market information across four categories: "Indicators Updates" (news on indicators), "Investment Anomalies" (analysis of non-standard market behavior), "Marketing Information" (details on the DML methodology), and "Tips and Tricks" (practical advice). To stay informed, users can subscribe to thematic newsletters in their client panel.

The DML EA JUMP & FLIP has been updated with a new, free feature for visualizing "JUMP" signals with arrows directly on the chart. The update allows traders to precisely analyze and verify when setups are generated, both in the Strategy Tester and on demo/live markets. The functionality is similar to that found in the advanced DML MultiButton Panel indicator. The update is available for free to all DeepMarketLevel.com clients.

The USD/JPY currency pair is experiencing unique market tension. The price has reached a rarely seen DML monthly resistance level, which could inhibit further gains. Simultaneously, a strong support zone has formed below the current price, created by a confluence of three key elements: a historical anomaly, current weekly supports, and an unclosed price gap. The upcoming release of the FOMC meeting minutes could be the catalyst that determines whether the market will test the lower support zone or react at the resistance.

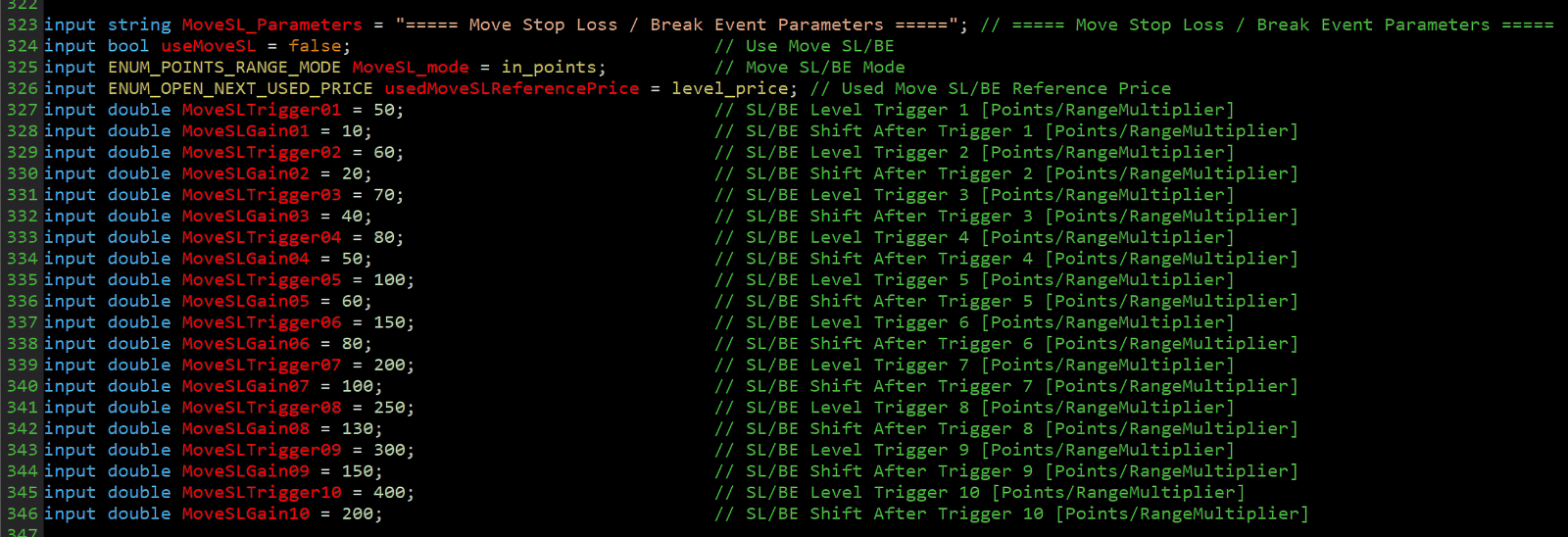

DeepMarketLevel.com has enhanced the "Move Stop Loss / Break Even" feature in all of its Expert Advisor (EA) tools. The update allows for advanced and fully automated management of the Stop Loss order. Users can configure up to 10 profit thresholds, and upon reaching them, the EA will automatically move the Stop Loss to a new level to set the position to break-even or to gradually secure the growing profit.

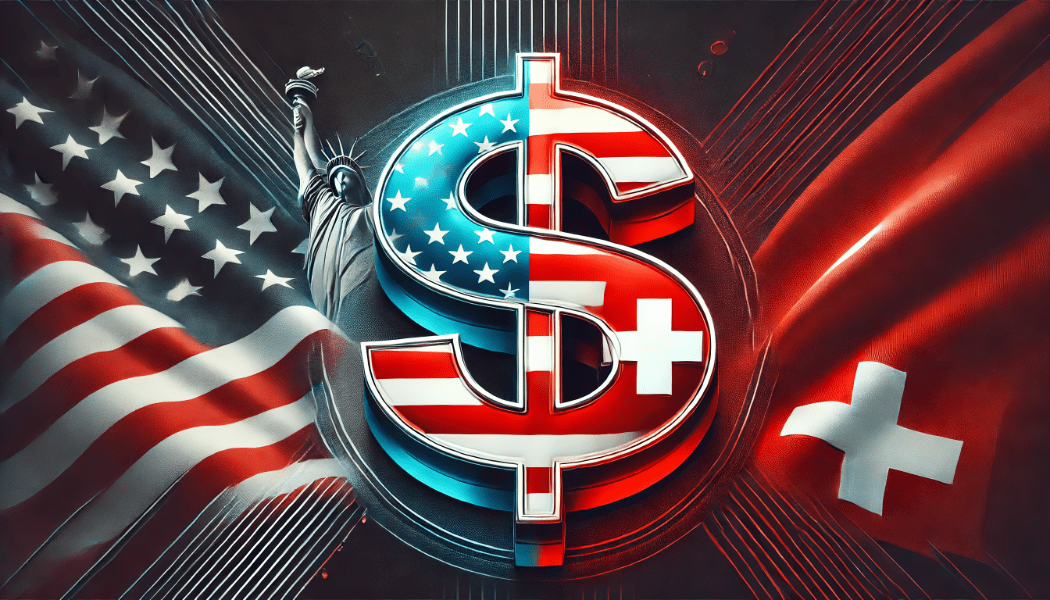

Why does the market sometimes ignore established patterns? In our latest case study, we reveal how a unique anomaly on the USDCHF pair defined a critical price zone where the market is currently trading. Discover how analyzing the 5% of non-standard events, made visible by DML levels, can give you a deeper insight into market structure and an informational edge.

The article discusses the trading philosophy of Mariusz Maciej Drozdowski, CEO of Deep Market Level, who in a recent interview presented the controversial thesis that financial markets are not chaotic but constitute an orderly system he called a "one big accounting firm." Using his proprietary MMD and DML methodologies, Drozdowski searches statistical data for repeatable patterns and "anomalies" that are said to predict future price movements. Despite his belief in the high effectiveness of his models, he defines himself more as a passionate researcher than a trader focused solely on profit.