EURJPY

The EURJPY currency pair combines the euro (EUR), the currency of the Eurozone, with the Japanese yen (JPY). The euro, as the second most important reserve currency in the world, reflects the economic health of the 19 countries that make up the Eurozone, including major economies like Germany, France, Italy, and Spain. Meanwhile, the Japanese yen is known as a safe-haven currency, meaning investors tend to favor it during times of market uncertainty or economic crises.

Characteristics and Specifics

- Economic condition of the Eurozone: The EURJPY exchange rate is closely tied to the economic performance of the Eurozone, which comprises 19 countries. Macroeconomic events such as changes in GDP, inflation, unemployment, and fiscal policy in individual countries affect the euro. Of particular importance are data from Germany, the largest economy in the Eurozone.

- Monetary policy and central bank interventions: The monetary policies of the ECB and BoJ significantly impact the volatility of EURJPY. The ECB may raise or lower interest rates depending on economic conditions and inflation, influencing the euro's attractiveness relative to the yen. Meanwhile, the BoJ, despite maintaining low interest rates, may intervene in the currency market if the yen's value strays too far from expectations.

- Global risk and market sentiment: As a currency pair combining a reserve currency and a safe-haven currency, EURJPY is particularly sensitive to global risk and shifts in market sentiment. During periods of increased uncertainty in international markets, the yen tends to appreciate, while the euro may weaken if European economies face crises.

Summary

EURJPY is a currency pair that offers unique trading opportunities based on the differences in the monetary policies of the ECB and BoJ, as well as the economic condition of the Eurozone. Exchange rate fluctuations for this pair can be heavily influenced by central bank actions and global market sentiment. Traders should monitor the evolving economic outlook in the Eurozone and potential BoJ interventions that could impact the yen's volatility.

EURJPY can be appealing to short-term traders who take advantage of volatility stemming from interest rate differentials and economic conditions in both regions. For long-term investors, it is important to follow economic trends in the Eurozone, monetary policy changes, and global risk appetite shifts to effectively predict future movements of this currency pair.

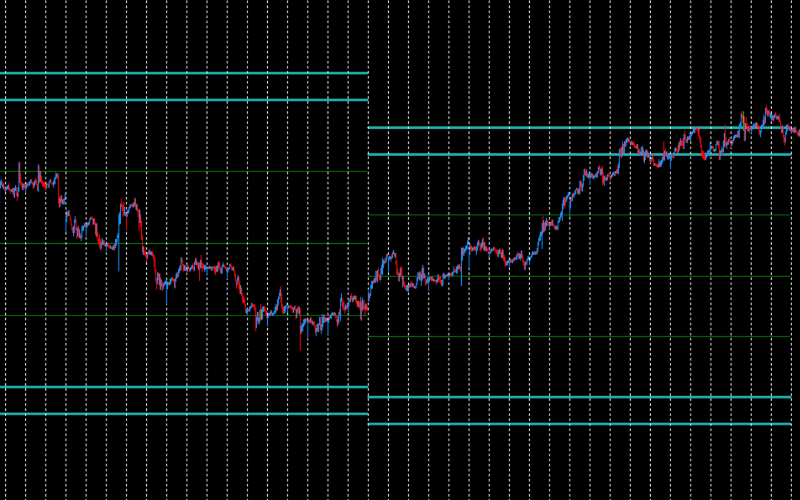

Example DML levels:

SeaGreen - Monthly Support & Resistance

SeaGreen levels are monthly supports and resistances set at the beginning of each calendar month. The price rarely reaches these levels, but when it does, it usually either changes direction long-term or consolidates at that level. This makes it an ideal level for investors and traders who position their trades over a longer time frame.

You can find more about SeaGreen levels here.

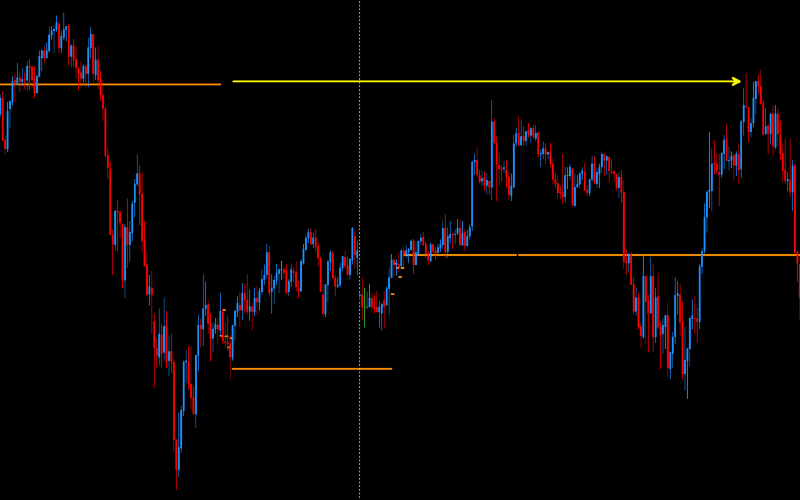

DarkOrange - precise price reactions

DarkOrange levels are closely linked to Violet levels, which are updated every hour, unlike DarkOrange levels, which are updated every 5 minutes. Both the data sources and calculation algorithms are identical. However, the more frequent 5-minute recalculations for DarkOrange levels have allowed the discovery of unique setups and models, as well as the observation of many anomalies unavailable for trading on Violet levels.

You can find more about DarkOrange levels here.

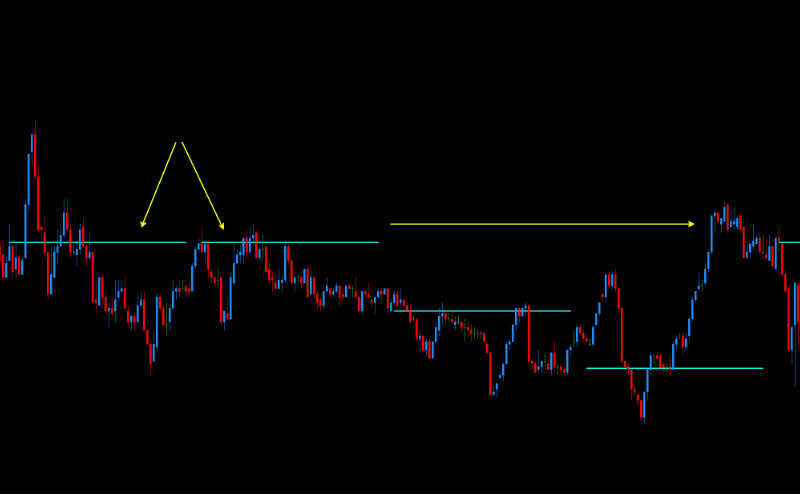

Aqua - DML Floating Levels

Aqua levels, similar to Violet levels, are retrieved every hour, although their characteristics are quite different. Violet levels, for reference, typically hold one level throughout most of the day, then shift to a new level in the evening after the Flow Zone (FZ). In contrast, Aqua levels usually appear near the current price level.

You can find more about Aqua levels here.

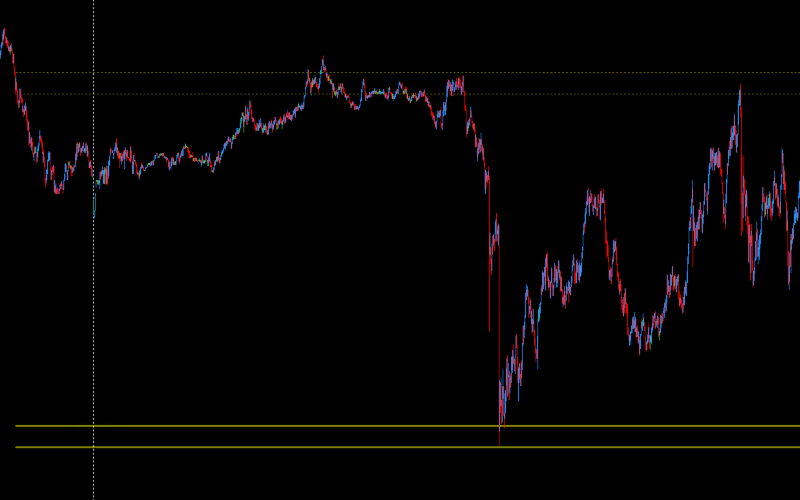

Olive - Daily Support and Resistance

Olive levels are generated once a day, around 19:00 GMT. This level consists of three zones. The middle zone is located around the price level at 19:00 GMT. The other two zones are located above and below the middle zone, at equal distances from it. The range of these distances varies daily and indicates the potential movement dynamics for the next day. The lower zone is a very strong support for the next trading day, while the upper zone is a strong resistance for the next trading day.

You can find more about Olive levels here.

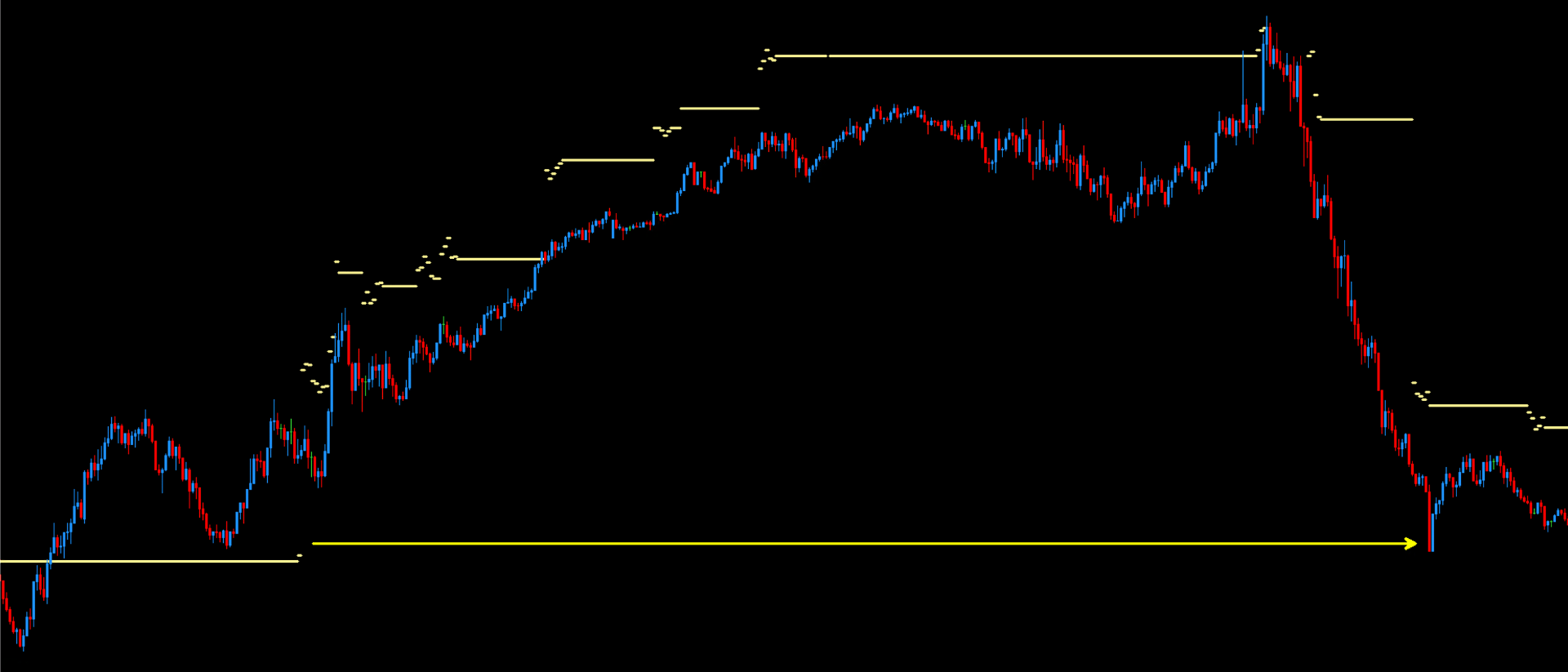

Khaki – Dynamic Supports and Resistances

Khaki levels on EURUSD are key resistance levels that play an important role in trading this currency pair. Exceeding the zone defined by these levels suggests that the price should return to them. Particularly important is the zone between the last Flow Zone (FZ), which appears in the morning, and 11:00 AM GMT. Levels ending after 12:00 PM GMT are also settled, but experience shows that treating Khaki levels as resistances until 11:00 AM is safer and has significantly better repeatability. The repeatability of returns to these levels is over 90%.

You can find more about Khaki levels here.