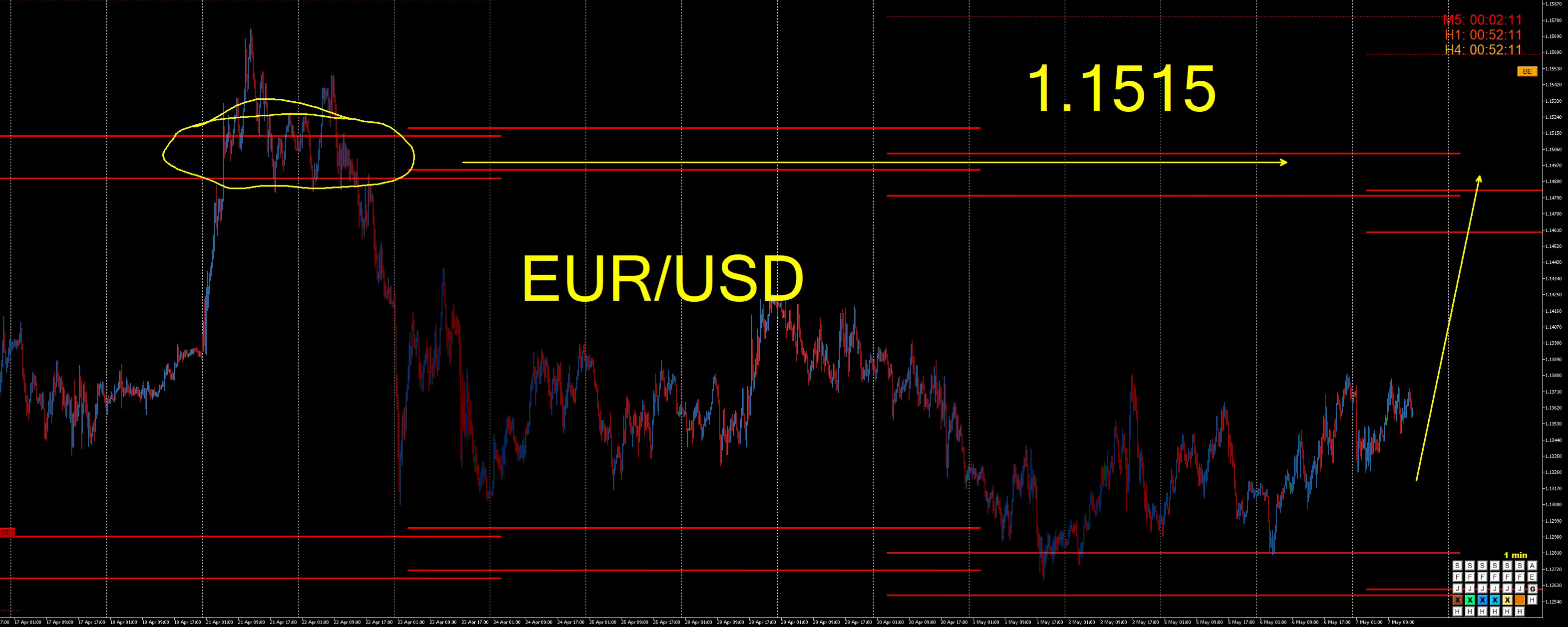

EUR/USD at a Crossroads

The EUR/USD currency pair is approaching a turning point that could define its medium-term direction. All investor attention is focused on the 1.1515 level, a key price zone derived from the Deep Market Level (DML) methodology. The market's behavior in this area will test not only technical strength but also market psychology, presenting two diametrically opposed scenarios.

The Two Faces of a Technical Barrier

The 1.1515 level, a significant DML RED weekly support in the past, was recently broken, leading to a wave of declines. The current upward movement is nothing more than a return to the area of this breakdown. Here, analysts are divided into two camps.

On one hand, we have proponents of classic technical analysis. For them, the situation is simple—according to the principle of polarity change, former support becomes new resistance after being broken. In this view, the current rally is merely a correction, and a retest of the 1.1515 level from below should generate a strong supply reaction and a resumption of the downtrend. This is a textbook scenario that many market participants are preparing for.

However, there is a second, much more sophisticated interpretation. It assumes that the initial support break was a deliberate maneuver - a market trap (a so-called bear trap). Its purpose was to trigger a false sell signal, induce traders to open short positions, and gather liquidity from the market before making the actual, intended move upwards.

The Main Scenario: Negating the Trap and a Bullish Impulse

If we accept the bear trap thesis, the current approach to 1.1515 is not a test of resistance but a trial of strength in which the demand side intends to regain control. In such a scenario, we would not see a sharp rejection upon reaching this zone. Instead, after a brief hesitation, the market should decisively push back above the 1.1515 level. Such a move would be the final negation of the trap, trapping sellers on the wrong side of the market and serving as a powerful signal for the continuation of the bullish wave. Confirmation of the buyers' strength would be the price holding above 1.1515, which should then begin to function as solid support once again.

What to Watch For

It will be crucial for investors to closely monitor the price action in the 1.1515 zone.

- Bullish Signal (Trap Confirmation): A decisive and sustained break above 1.1515, followed by a successful defense of this level as new support.

- Bearish Signal (Classic Resistance): A clear rejection of the level, the appearance of bearish candlestick patterns, and a price turn to the south without an attempt to overcome the resistance.

Conclusion

The 1.1515 level on the EUR/USD pair is currently the most important point on the technical map. It is much more than a line on a chart - it is a battleground between classic analysis and the theory of market manipulation. The outcome in this area will not only indicate the dominant force in the market but will also offer a clear signal regarding the future direction for the world's main currency pair.

This analysis is a market commentary based on the DeepMarketLevel methodology and does not constitute investment advice or a trading recommendation.