DML EA Olive

DML EA Olive is a robot (EA) for the MetaTrader platform that automates research and trading based on daily Olive levels. It applies a grid strategy, opening positions in reaction to the price at key support/resistance zones. It has extensive risk management functions (SL/TP/BE) and filters (time, trend) for precise control.

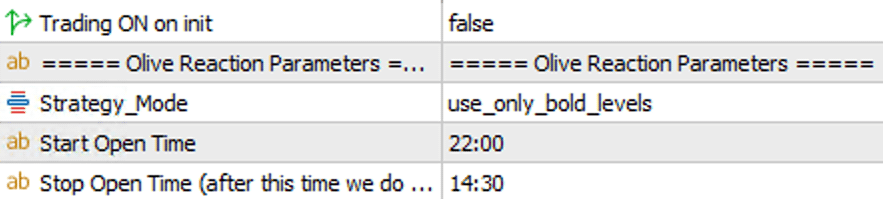

Main Startup Settings

- Trading ON on init: Determines whether the EA should start trading automatically when placed on the chart.

- Setting it to `false` (default) provides a safety measure. After an accidental platform restart, the robot will manage existing orders but will not open new ones without manual activation via the on-chart button.

- Setting it to `true` will start trading immediately.

Important Note: When backtesting in the Strategy Tester, the Trading ON on init parameter must be set to TRUE. Otherwise, the tester will visualize the levels, but the robot will not open any positions.

Strategy Modes

The parameter allows the user to choose which of the downloaded Olive levels are used to open positions.

- use_only_bold_levels: In this mode, the robot will initiate trades exclusively based on the primary zone created by the two main (bold) Olive levels for the given day. It ignores additional, wider levels.

- use_extreme_level: In this mode, the robot considers all available Olive levels (both primary and extreme/outer). For trading, it will use the widest possible range, meaning the highest resistance level and the lowest support level from all available levels for that day.

Start and Stop Open Time

The Start Open Time and Stop Open Time functions define the time window during which the robot can open new order grids (setups).

- Start Open Time: This defines the time from which the Expert Advisor can start opening new positions. Before this time, no new trades will be initiated.

- Stop Open Time: This defines the time after which the robot stops opening new positions. This is a "soft stop"-it doesn't close existing orders or open grids, but only blocks the ability to initiate subsequent ones.

In the provided code, the default settings (startOpenTime = "22:00", stopOpenTime = "14:30") mean the robot can open new setups from 10:00 PM on one day until 2:30 PM on the next day.

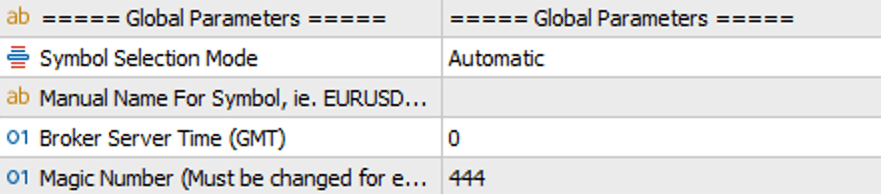

Global Parameters

Basic configuration settings for the EA.

- Symbol Selection Mode: `Automatic` auto-detects the symbol from the chart. `Manual` allows you to enter the instrument name by hand.

- Manual Name For Symbol: A field to manually enter the symbol (e.g., `EURUSD`) when in `Manual` mode.

- Broker Server Time (GMT): Sets the time zone offset of your broker's server relative to GMT.

- Magic Number: A unique identifier. Each EA instance on your platform must have a different Magic Number to avoid conflicts.

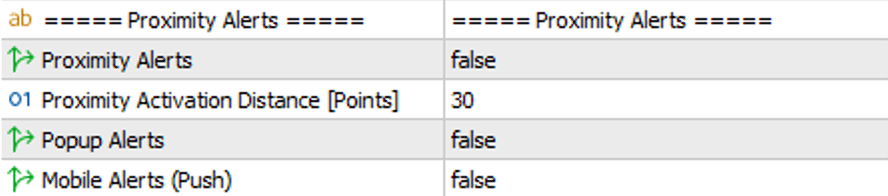

Proximity Alerts

This feature notifies you when the price approaches a selected DML level.

- Proximity alerts: Enables or disables the alert functionality.

- Proximity activation distance (Points): Specifies the distance in points from the level that will trigger an alert.

- Popup Alerts: Enables pop-up notifications on the MT5 platform.

- Mobile Alerts: Enables push notifications to your MT5 mobile app.

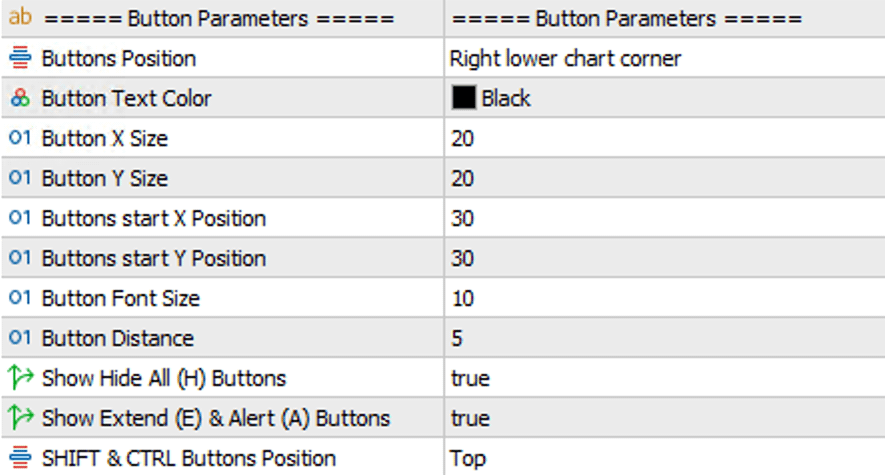

Button Parameters

Settings for the on-chart control panel.

- Show Button: Shows or hides the button panel on the chart.

- Buttons Position: Selects the corner of the chart where the panel will be displayed.

- Helper Buttons: The panel includes additional function buttons:

- H (Hide): Toggles the visibility of all DML levels on the chart.

- E (Extend): Activates a mode to permanently extend level lines into the future.

- A (Alert): Activates a mode to permanently set proximity alerts on levels.

- Helper Buttons Position: This parameter determines where the helper buttons (H, E, A) will appear relative to the main level buttons (e.g., top, bottom, left, or right).

- Other Parameters: Allow for detailed customization of the panel's appearance, such as button size (`Button X/Y Size`), text color, font size, and spacing.

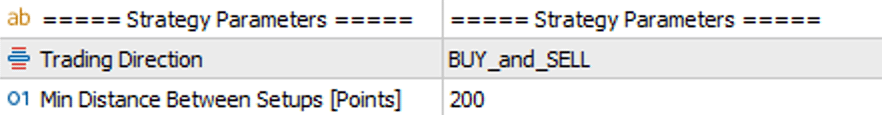

Strategy Parameters

Trading Direction: This parameter is a global filter for trade direction that works independently of the chosen strategy. It allows you to force the EA to open positions only in one specific direction.

- BUY_and_SELL: The EA opens both buy and sell positions.

- only_BUY: The EA will only open buy positions.

- only_SELL: The EA will only open sell positions.

Min Distance Between Setups: This parameter defines the minimum distance in points that must be maintained between a newly opened setup and any other already existing on the chart. This is a safeguard against opening too many order grids in close proximity, which could lead to an excessive concentration of risk.

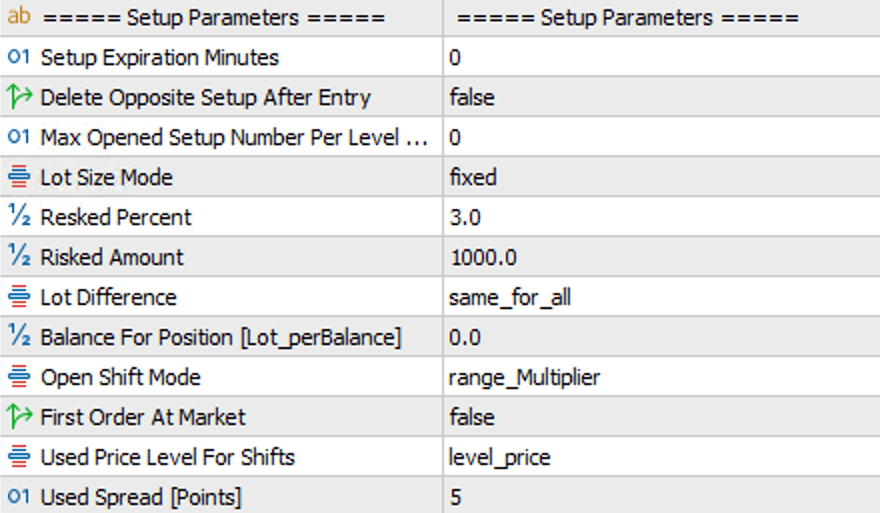

Lot Size Management / Setup Parameters

Lot Size Mode: Choose how the EA should calculate the size of the positions it opens.

- fixed: The EA will use the exact lot values you enter in the Position Size... fields for the grid or pyramid.

- Lot_perBalance: Calculates position size based on the account balance. In the Balance For Position field, you specify what amount of the balance should correspond to one order (e.g., 0.01 lots for every 1000 units of currency).

- Risk_from_Balance / Equity / Amount: Risk management modes. The EA will automatically calculate the position size for the entire grid so that if the Stop Loss is hit, the loss will not exceed a set percentage of your capital (Resked Percent) or a specific amount (Risked Amount).

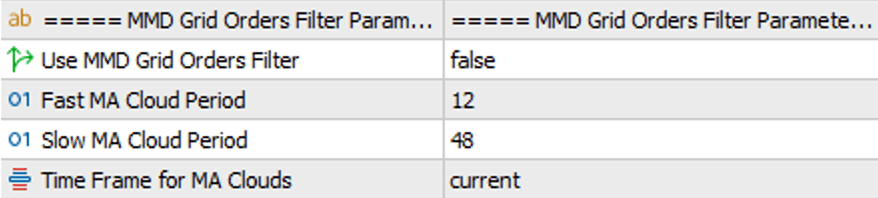

MMD Grid Orders Filter

This group of parameters is used to configure a trend filter based on the MMD methodology. Its purpose is to conditionally allow the opening of subsequent orders in a grid based on the analysis of moving average clouds. This filter applies to all positions in the Grid, beyond the value entered in the Open Pending Grid Number parameter.

- Use MMD Grid Orders Filter

The main on/off switch for the filter. Setting it to

trueactivates filtering. Whenfalse, subsequent grid orders will be opened based solely on the price levels defined in the grid parameters, without trend verification. - Fast MA Cloud Period

Defines the period for the fast moving average cloud. Based on this value, the EA creates a cloud consisting of a Simple Moving Average (SMA) and an Exponential Moving Average (EMA) of the same period. This cloud reacts more quickly to price changes.

- Slow MA Cloud Period

Defines the period for the slow moving average cloud. Similarly, it creates a cloud from an SMA and EMA with a longer, smoother period, which helps in identifying a more stable trend.

- Time Frame for MA Clouds

Defines the timeframe on which both moving average clouds are calculated. This allows the trend analysis to be based on a different timeframe than the one the Expert Advisor is running on.

How the filter works:

The MMD filter analyzes the relative position of the clouds.

- To open a subsequent BUY order from the Grid, the fast moving average cloud must be above the slow moving average cloud.

- To open a subsequent SELL order from the Grid, the fast moving average cloud must be below the slow moving average cloud.

If the condition is not met (e.g., the EA wants to open a BUY position, but the clouds indicate a downtrend), the order will not be opened, even if the price reaches its level from the Grid. The EA will wait for the moment the cloud configuration reverses and aligns with the direction of the grid being built.

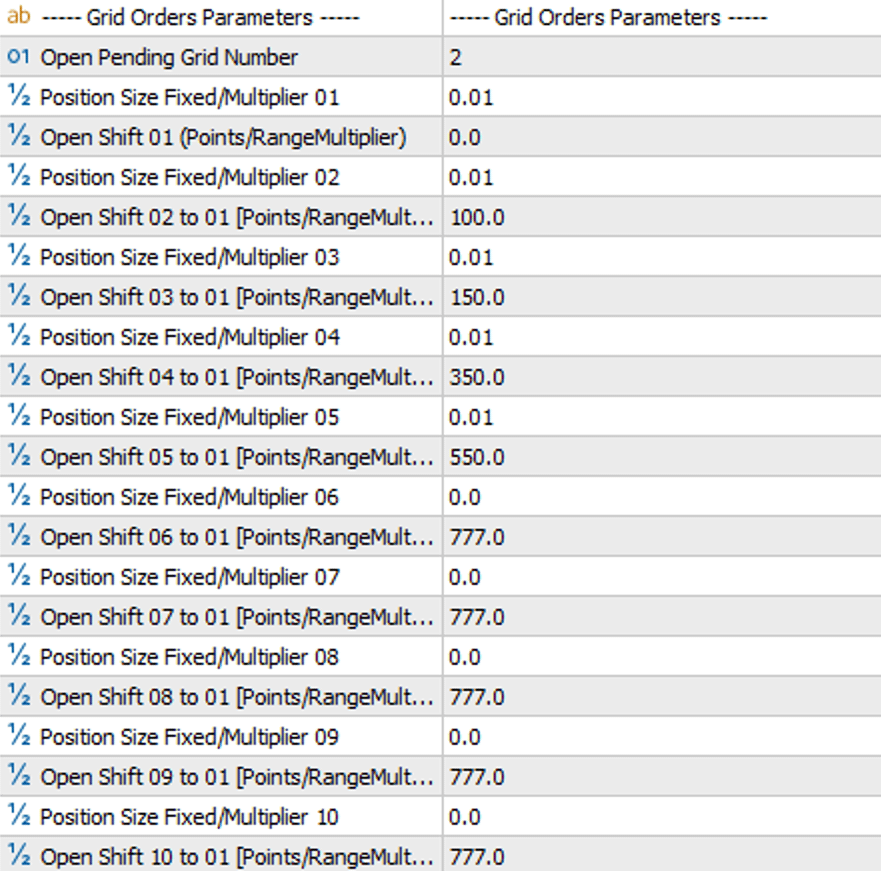

Grid Setup Parameters

Open Pending Grid Number: This parameter manages how the Expert Advisor builds the grid of pending orders on the market.

- Description: It defines how many pending orders from the grid are placed on the market at one time. After an initial signal, the EA places exactly the number of pending orders defined in this parameter (e.g.,

2). Subsequent orders from the grid are not added automatically after a previous one is activated. - Logic for Placing Subsequent Orders:

A new pending order from the sequence is placed only when the price reaches the level defined for that order in the grid parameters. This process, however, depends on the state of the MMD Grid filter:

- When the MMD filter is disabled (

Use MMD Grid Orders Filter=false): The EA will unconditionally place the next pending order as soon as the price touches its defined level in the grid. - When the MMD filter is enabled (

Use MMD Grid Orders Filter=true): For the EA to place the next pending order, two conditions must be met simultaneously:- The price must reach the level of that order as defined in the Grid.

- The direction indicated by the moving average clouds must be consistent with the order's direction.

- When the MMD filter is disabled (

A grid involves opening subsequent orders at predetermined intervals as the price moves against your initial position. The main goal is to average the entry price, which means a smaller price movement in the desired direction is needed to achieve profit or reach Break-Even.

Position Size Fixed/Multiplier 01 ... 10: Here you define the lot size for each of the up to 10 levels of the grid. If you only want to use 5 orders, leave the value 0.0 in fields 06 through 10.

Open Shift 01 ... 10: This is a crucial setting that determines where the pending orders will be placed. It works as follows:

- Open Shift 01: Defines the distance of the first order from the DML SkyBlue level. A value of 0 means the first order will be placed exactly on the level.

- Open Shift 02 to 10: Define the distance of subsequent orders from order #1. This is not the distance from the previous order, but from the first one.

Open Shift Mode: Decides how the distance for the Open Shift parameter is measured:

- range_Multiplier: The distance is dynamic and depends on the DML level's "range," which is the distance between the solid line (main level) and the dashed line (extended level).

- in_points: The distance is fixed and specified directly in points.

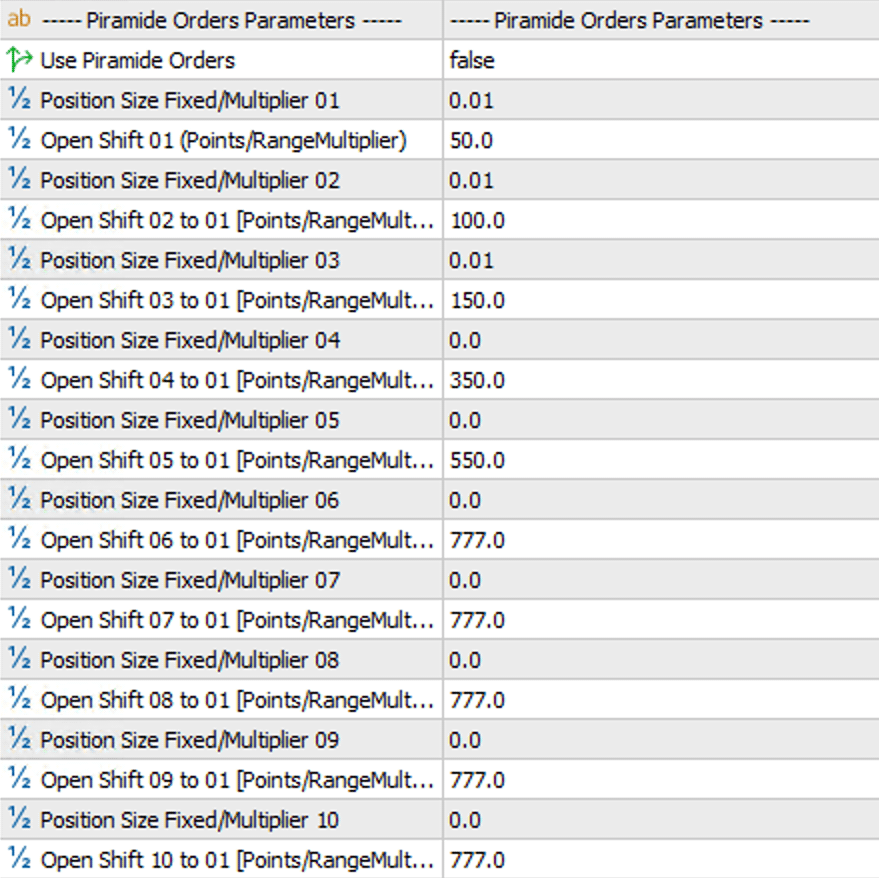

Pyramid Setup Parameters

Pyramiding is a strategy of adding more orders as the price moves in the direction of your open position that is already profitable. The goal is to maximize profit during a strong, one-directional market move.

Use Piramide Orders: The master switch (true/false) to enable or disable the entire pyramiding function.

Position Size Fixed/Multiplier 01 ... 10 (in the Piramide section): Works the same as in the grid—it specifies the lot size for each subsequent order added to a profitable position.

Open Shift 01 ... 10 (in the Piramide section): Defines how far from the initial order the next positions should be opened. Unlike the grid, these distances are calculated in the profitable direction.

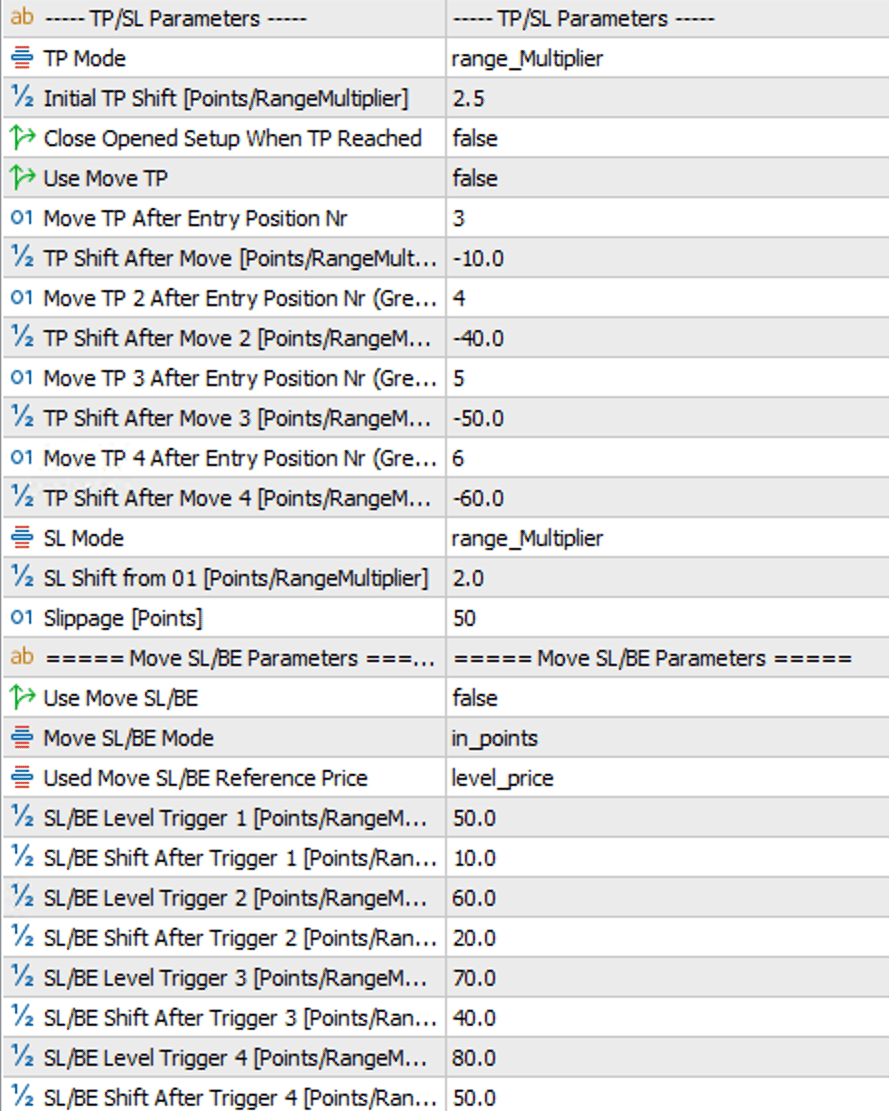

TP & SL Management

Advanced options for managing Stop Loss and Take Profit orders.

- TP Mode / SL Mode: Allows setting Take Profit and Stop Loss levels in points (`in_points`) or as a multiplier of the range (`range_Multiplier`).

- Use Move TP: Activates the dynamic Take Profit adjustment feature. You can define up to 4 conditions – after a specific position in the grid is opened, the common TP for all orders will be moved to a new, defined level.

- Move SL/BE: A dynamic function to move the Stop Loss (or to Break Even).

- Reference Price: The reference point for calculations can be the price of the first order or the DML level that generated the signal.

- Triggers & Shifts: You can set 4 thresholds. Each threshold consists of two values: the distance from the reference point that activates the change (Trigger), and the new level to which the SL will be moved (Shift).

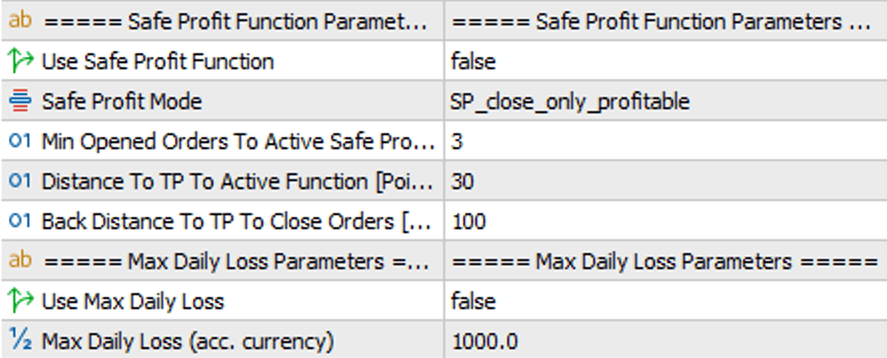

Risk & Safety Functions

Additional modules to protect capital and secure profits.

- Safe Profit Function: A profit protection feature. It's activated after a specific position number is opened. When the price gets close to the TP by a defined distance, the function "arms" itself. If the price then retreats and reaches a second defined distance, the orders are closed.

- Operating Modes: It can close all positions in the setup, or only those that are currently in profit. In the second scenario, positions closed with a profit will be re-established as pending orders.

- Max Daily Loss: The maximum allowable daily loss in your account currency. Once reached, the robot stops opening new setups for that trading day.

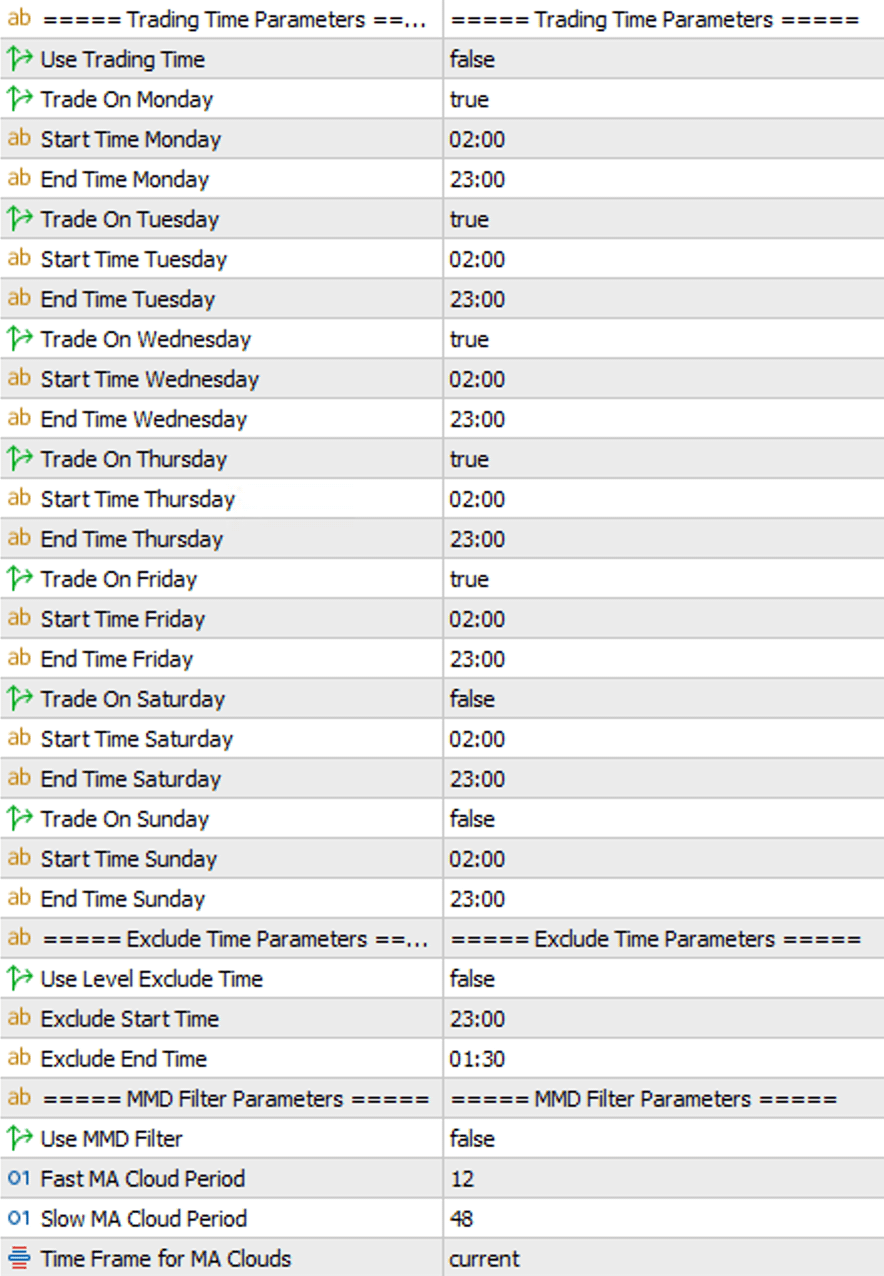

Time & Session Filters

Time filters allow you to adapt the EA's operation to specific sessions or avoid undesirable market periods.

- Trading Time Parameters: Allows you to precisely define the days of the week and hours during which the robot is allowed to open new setups.

- Exclude Time Parameters: Lets you define a "time window" during which the robot will not open new orders (e.g., during spread widening at session rollovers). All previously opened setups will continue to be managed according to their logic.

- MMD Filter Parameters: A trade filter based on the MMD methodology (moving average clouds). It allows you to define two moving averages (SMA and EMA) from a selected timeframe. The robot will only open positions if the Olive signal aligns with the direction indicated by the clouds, enabling strategies like trading with the higher-timeframe trend.

Download

To download the current version of DML EA Olive, go to the Download section in your client panel.